Loading

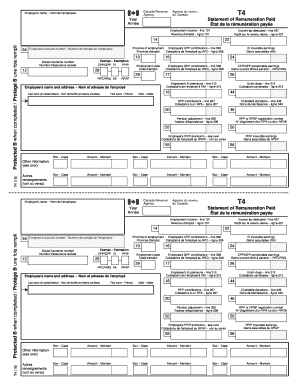

Get Canada T4 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T4 online

The Canada T4 form is a crucial document for reporting employment income and related tax information. Accurately completing this form is essential for both employers and employees to ensure compliance with tax regulations.

Follow the steps to complete the T4 form online effectively.

- Press the ‘Get Form’ button to access the Canada T4 document and open it in the editor.

- Begin by entering the employer's name in the designated field at the top of the form.

- Indicate the year for which the remuneration is being reported.

- In the employment income section (line 101), fill in the total earnings for the year.

- Add the total income tax deducted on line 437 to reflect the amounts withheld.

- Provide the province of employment to confirm the location of the work.

- Enter the employee's Social Insurance Number to uniquely identify the individual.

- Fill out the employee's name and address fields, ensuring the last name is in capital letters.

- Complete the sections on employee's contributions, including CPP, QPP, and EI premiums, as applicable.

- Report any union dues, charitable donations, and pension adjustments in the respective lines.

- Review all entries for accuracy and completeness.

- Finally, save your changes and download, print, or share the completed T4 form as needed.

Complete your Canada T4 form online today to stay compliant with tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A T4 form in Canada is a tax slip that indicates your total earnings and deductions for the year from your employer. This document summarizes your employment income, taxes withheld, and other deductions. It's crucial for filing your annual tax return. Make sure to keep your T4 handy, as it provides essential information needed to complete your tax forms accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.