Loading

Get Canada Fin 360/web - British Columbia 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada FIN 360/WEB - British Columbia online

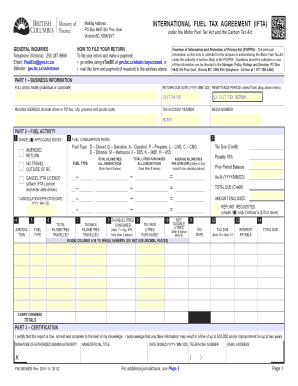

Filling out the Canada FIN 360/WEB form for British Columbia is essential for reporting fuel tax. This guide will assist users in navigating the form with clarity and ease, ensuring that all necessary information is correctly submitted.

Follow the steps to complete your Canada FIN 360/WEB form online.

- Press the ‘Get Form’ button to access the Canada FIN 360/WEB online document and open it in your preferred editor.

- Enter your full legal name, whether you are an individual or representing a corporation, in the designated field.

- Provide the return due date in the format of YYYY/MM/DD to indicate when the filing is due.

- Select the remittance period from the drop-down menu to indicate the specific period for which you are filing.

- Fill in your mailing address, ensuring to include all necessary details such as street or PO box, city, province, and postal code.

- In Part 2, shade the applicable boxes to indicate whether there was no travel outside British Columbia. Record the fuel type and relevant dates in the specified sections.

- Provide the total kilometres travelled, taxable kilometres travelled, and taxable litres consumed in their respective fields, ensuring that you round these numbers to whole digits.

- Calculate and enter the average kilometres per litre (KPL), rounding to two decimal places if necessary.

- Complete the section on tax due, entering the values that correspond with your calculations from previous sections, including tax paid litres purchased.

- In Part 3, certify your report by signing in the designated area, including your name, official title, date signed, telephone number, and email address.

- Once you have filled out all sections accurately, review your document to ensure no fields are left incomplete. Save your changes, download the document, and prepare for printing or sharing as needed.

Complete your Canada FIN 360/WEB form online today for efficient processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file a zero income tax return, you simply need to complete the tax forms and indicate that your income for the year was zero. It is important to include your personal details accurately to meet regulatory requirements. Utilizing services like uslegalforms can make this process straightforward and ensure you adhere to Canada FIN 360/WEB - British Columbia guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.