Loading

Get Canada Form 236 1992-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Form 236 online

This guide provides clear and detailed instructions on how to fill out the Canada Form 236 online. By following the steps outlined below, you will be able to navigate the application process with ease and confidence.

Follow the steps to successfully complete your application

- Press the ‘Get Form’ button to obtain the form and open it in your preferred digital format.

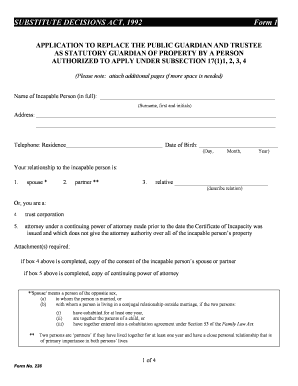

- In the first section, enter the full name of the incapable person, including their surname, first name, and initials.

- If you selected 'trust corporation' or 'attorney,' attach the required documentation as specified in the form.

- List any additional persons entitled to apply under subsection 17(1), and indicate whether you have informed them about your application and their support or opposition regarding your appointment.

- In the applicant's statement section, answer all questions truthfully, including your personal contact history with the incapable person and your willingness to fulfill guardian duties.

- Provide details regarding the total approximate value of the incapable person's property and include particulars of the assets in the attached Management Plan.

- Add your signature, print your name, and provide your contact information at the bottom of the form.

- After completing the form, you can save your changes, download the completed document, or print and share it as needed.

Complete your forms online today for a smoother application process!

You typically have to fill out a customs declaration form when you arrive in Canada. This is required to disclose any items you are bringing that may be subject to duty or restrictions. Completing the form properly helps facilitate your entry and keeps you in good standing with customs regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.