Loading

Get Au Nat 0660 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 0660 online

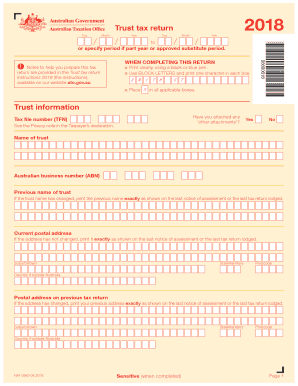

The AU NAT 0660 is a crucial document for trust tax returns in Australia. Filling this form accurately is essential for proper tax reporting and compliance. This guide provides a step-by-step approach to assist users in completing the form online with ease.

Follow the steps to complete the AU NAT 0660 online.

- Click the ‘Get Form’ button to access the online version of the AU NAT 0660. This will open the form in your editor.

- Begin by filling out the trust information section. Include the tax file number (TFN), Australian business number (ABN), and the name of the trust. Ensure the information matches any previous notices or tax returns.

- Provide the current postal address of the trust. If the address has changed from previous submissions, input the previous address verbatim.

- Fill in the full name of the trustee, ensuring to include contact details. Indicate the type of trust by writing the appropriate code in the designated field.

- Complete the income and expenses sections for your trust. Enter all amounts in whole dollars and use the correct corresponding labels as specified in the form.

- If there have been any distributions or additional income types, note them in the relevant sections according to the form's instructions.

- Review all entries for accuracy. Make sure to include any attachments if required, especially for trusts that meet specific criteria.

- Once all sections are completed and reviewed, users can save the form, download, print, or share it as needed to finalize their tax submission.

Complete your AU NAT 0660 form online today to ensure timely and accurate tax reporting.

Yes, trusts are generally required to file tax returns if they generate income. Even if a trust does not distribute any income, it must file Form 1041 to report financial activities. Keeping the AU NAT 0660 in mind is essential to ensure compliance during the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.