Loading

Get Dol 5500-sf 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DoL 5500-SF online

Filling out the DoL 5500-SF online is a crucial step for ensuring compliance with federal regulations governing employee benefit plans. This guide will provide you with a comprehensive overview and detailed, step-by-step instructions to help you navigate the form with confidence.

Follow the steps to complete the DoL 5500-SF form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

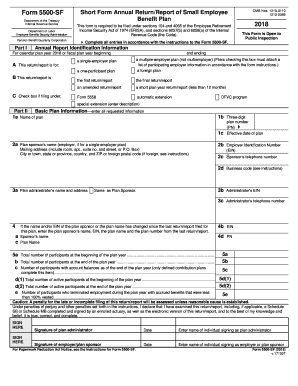

- Begin by providing the annual report identification information. Indicate whether this return/report is for a single-employer plan, multiple-employer plan, one-participant plan, or a foreign plan by checking the corresponding box.

- Fill in your plan years, stating the beginning and ending dates. Be sure to select if you're filing the first return, an amended return, or a special extension.

- Enter the basic plan information as requested. This includes the name of the plan, the plan sponsor's name, mailing address, city, state, and ZIP code.

- Provide information about the plan administrator. If the information is the same as the plan sponsor, indicate this by checking the box.

- Complete Part III, which requires financial information such as total plan assets, total plan liabilities, and net plan assets.

- Address compliance questions by answering yes or no to the inquiries regarding participant contributions, transactions with parties-in-interest, and fidelity bonds.

- Finish by signing the document where indicated, providing the names of the individuals signing as plan administrator and employer/plan sponsor.

- Last, review all entries to ensure accuracy. Once you are satisfied with the form, you can save changes, download, print, or share the completed DoL 5500-SF.

Start filling out the DoL 5500-SF form online today for a smooth filing experience.

Filing the DoL 5500-SF involves completing the form and submitting it electronically through the ERISA Filing Acceptance System. It is crucial to gather all necessary information, such as plan details and participant data, before starting the submission. Considering using platforms like uslegalforms can streamline this process, providing guidance and templates to ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.