Get Sec Form 1-k (sec2913) 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SEC Form 1-K (SEC2913) online

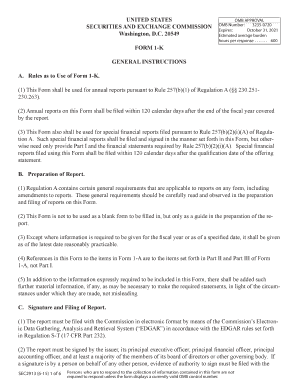

Filling out the SEC Form 1-K (SEC2913) online is a critical process for issuers submitting annual and special financial reports. This guide provides a step-by-step approach to ensure accurate and compliant submission.

Follow the steps to complete the SEC Form 1-K online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Part I, which requires basic issuer information. Include the exact name, jurisdiction of incorporation, IRS Employer Identification Number, principal executive office address, phone number, and details about the securities issued under Regulation A.

- Provide summary information regarding prior Regulation A offerings, including commission file number, offering statement qualification dates, commencement dates, amounts of securities qualified and sold, and related fees.

- Complete Part II, which includes detailed responses on business operations, financial analysis, directors and officers, management transactions, and financial statements.

- Ensure that the financial statements are aligned with the U.S. Generally Accepted Accounting Principles or International Financial Reporting Standards as applicable to the issuer.

- Incorporate any additional material information necessary to ensure clarity and avoid misleading statements.

- Sign the report electronically, ensuring that it includes signatures from the issuer’s principal executive, financial officers, and the majority of the governing body. Typing names in the designated signature field is necessary.

- Review the completed form for accuracy and compliance, then submit it electronically through the SEC's submission system.

- Save changes, download a copy for your records, or print the report to share as needed.

Ensure timely filing of your SEC Form 1-K online to meet regulatory requirements.

The purpose of SEC Form 13F is to increase transparency in the financial markets by providing insight into the investment holdings of major institutional managers. This helps investors and regulators track significant ownership stakes and market movements. By promoting accountability, the form aims to protect investors and maintain fair trading practices. Understanding the importance of SEC Form 13F (SEC2913) can enhance your investment decision-making and strategy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.