Loading

Get Rrb G-88a.2 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RRB G-88A.2 online

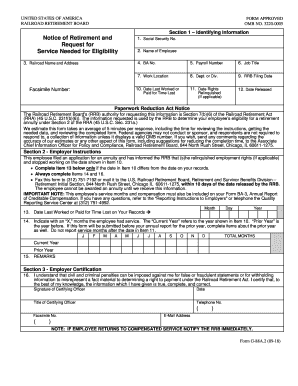

The RRB G-88A.2 form is crucial for notifying the Railroad Retirement Board of an employee's retirement and related service information. This guide provides step-by-step instructions to help users complete the form online with accuracy and confidence.

Follow the steps to successfully complete the RRB G-88A.2 form.

- Click the ‘Get Form’ button to access the form and open it in your online editor.

- In Section 1, fill in the identifying information. Start with the employee's Social Security number followed by their full name, railroad name, and address. Continue with the BA number, payroll number, job title, work location, department or division, RRB filing date, date rights, date of release, and the date last worked or paid for time lost.

- Complete Section 2 as an employer. Note if the employee relinquished their employment rights and provide the last worked date if it differs from your records. Mark the service months for both the current year and the prior year by indicating with an ‘X’ in the appropriate boxes.

- In Section 3, certify the information by signing the form. Include the date, title of the certifying officer, telephone number, and facsimile number. Provide your email address for any follow-up communications.

- Review all entries carefully for accuracy. Once satisfied with the information completed, save the changes. You can then choose to download, print, or share the form directly from your online editor.

Complete your documents online today for a smooth submission process.

The railroad Tier 2 limit refers to the maximum benefit you can receive from Tier 2 retirement. As set by the RRB, this limit fluctuates based on legislative changes and your service history. Understanding the RRB G-88A.2 can help clarify your potential maximum benefit. Staying informed ensures you can maximize your retirement planning and benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.