Get Fdic Suspicious Activity Report 2000-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FDIC Suspicious Activity Report online

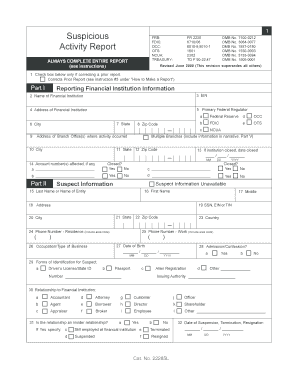

Filling out the FDIC Suspicious Activity Report (SAR) online is a crucial task for financial institutions to report known or suspected criminal activity. This guide will provide clear instructions on each section and field of the form to ensure accurate and complete submissions.

Follow the steps to effectively complete the FDIC Suspicious Activity Report online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part I, providing the reporting financial institution's information, including name, EIN, address, primary federal regulator, and state.

- If applicable, fill out the information regarding branch offices where the suspicious activity occurred. Include the city and zip code for each branch.

- In Part II, enter the suspect's information. This includes last name, first name, middle initial, address, SSN, and occupation/type of business.

- Indicate the suspect's relationship to the financial institution and check if the relationship has an insider status.

- For Part III, specify the suspicious activity details. Enter the total dollar amount involved and the date or date range of the activity.

- Provide a summary characterization of the suspicious activity from the listed options, including any known losses and recoveries.

- Complete Part IV with the contact information for the person reporting the suspicious activity.

- Finally, in Part V, offer a detailed explanation and description of the suspicious activity, covering all relevant points specified in the form.

- Once all sections are completed, save changes, download, print, or share the filled-out form as necessary.

Start filling out the FDIC Suspicious Activity Report online to ensure compliance and assist in reporting suspicious activities.

To fill out a SAR form, start by reviewing the necessary guidelines laid out by the FDIC. Ensure you have all pertinent information about the suspicious activity, including dates, amounts, and involved parties. Accurately completing every section of the SAR form is crucial to fulfill legal obligations. If needed, USLegalForms can offer valuable tools and insights to help you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.