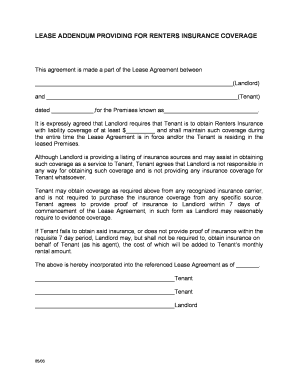

Get Lease Addendum Providing For Renters Insurance Coverage 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lease Addendum Providing for Renters Insurance Coverage online

Filling out the Lease Addendum Providing for Renters Insurance Coverage is an important step in ensuring financial protection for both the tenant and the landlord. This guide will help you navigate the form and understand its components clearly.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the name of the landlord in the designated space. This information identifies the party responsible for the lease agreement.

- Next, fill in the tenant's name in the corresponding section. This ensures that the person responsible for fulfilling the lease requirements is clearly identified.

- Enter the date of the lease agreement in the specified field. This date marks the beginning of the contractual relationship between the landlord and the tenant.

- Provide the address or name of the premises in the section provided. This identifies the location tied to the lease agreement.

- Specify the required liability coverage amount for renters insurance. This should be agreed upon by both parties and clearly stated in the form.

- Review the clauses that explain the landlord’s role in assisting with obtaining insurance and clarify that the tenant is ultimately responsible for securing coverage.

- Ensure to mention that the tenant must provide proof of insurance to the landlord within 7 days. This is critical to fulfill the lease conditions.

- Review the consequences outlined for failing to obtain insurance, which may include additional charges being added to the monthly rent.

- Finalize the document by signing and dating in the designated areas for both tenant(s) and landlord. This is essential for the document’s validity.

- After completing the form, save your changes, and consider downloading or printing the form for your records. You may also share it as needed.

Take the next step to protect your investment and obligations by filling out the necessary documents online.

To show proof of renters insurance, you typically need to provide a certificate of insurance to your landlord. This document outlines your coverage details and confirms that the required insurance is active. If you have a lease addendum providing for renters insurance coverage, share this with your insurer to ensure all stipulated requirements are met. For assistance in creating such documents, US Legal Forms offers user-friendly templates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.