Loading

Get Historic Tax Credit Application Feestechnical Preservation Services ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Historic Tax Credit Application Fees Technical Preservation Services online

Filling out the Historic Tax Credit Application can be a straightforward process when approached step-by-step. This guide provides detailed instructions to help you complete the application accurately and efficiently online.

Follow the steps to successfully complete the application form

- Press the ‘Get Form’ button to access the Historic Tax Credit Application. This will allow you to open the document and begin filling it out.

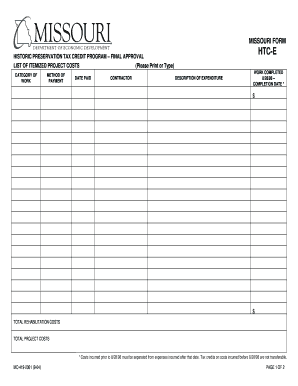

- In the 'Category of Work' section, specify the type of work performed on the property. Ensure that this aligns with what is included in your final approval request.

- Next, indicate the 'Method of Payment' for each expenditure. This will help to clarify how the costs have been settled.

- Enter the 'Date Paid' for each itemized cost. This date is critical to demonstrate when costs were incurred.

- Fill in the 'Contractor' name who performed the work. Accurate listings will help validate your claims.

- In the 'Description of Expenditure' column, provide detailed information about each itemized cost, ensuring clarity and relevance.

- Document the 'Completion Date' of the work done, ensuring this date reflects when the project was fully completed.

- Calculate and enter 'Total Rehabilitation Costs' and 'Total Project Costs' at the bottom of the form, ensuring these are accurate and reflective of your expenditures.

- To finalize your application, be sure to sign the document as the property owner. Review the affirmations regarding the accuracy of your expenses and compliance with regulations.

- Once everything is filled out, save your changes. You may download, print, or share the completed form as needed.

Proceed with completing your Historic Tax Credit Application online today.

Wisconsin Historic Tax Credits The Historic Preservation Tax Credit applies to certified historic buildings. Under the program, owners of eligible buildings may receive a state income tax credit for 20 percent of the qualified rehabilitated expenditures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.