Get Pa W-2 Information 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA W-2 Information online

Filling out the PA W-2 Information online is an essential task for accurately reporting taxable wages and income for the state of Pennsylvania. This guide will provide clear, step-by-step instructions to help you complete the form efficiently and correctly.

Follow the steps to complete the PA W-2 Information online.

- Click 'Get Form' button to access the W-2 Information form and open it in your digital environment.

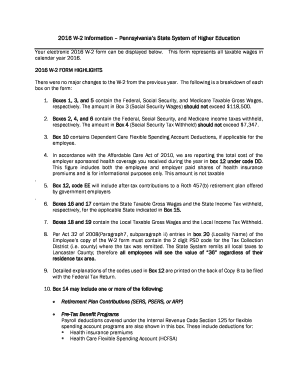

- In Box 1, enter your Federal Taxable Gross Wages for the year. Ensure this amount is accurate as it reflects your total earnings.

- In Box 2, input the total Federal income tax withheld from your wages throughout the calendar year.

- Fill in Box 3 with your Social Security Taxable Gross Wages. Remember, the amount should not exceed $118,500.

- Box 4 requires you to specify the total Social Security Tax withheld. This amount should not exceed $7,347.

- If applicable, enter any deductions for the Dependent Care Flexible Spending Account in Box 10.

- In Box 12, report the total cost of employer-sponsored health coverage under code DD for informational purposes only.

- For those contributing to a Roth 457(b) retirement plan, note this in Box 12 under code EE.

- Boxes 16 and 17 will contain your State Taxable Gross Wages and the State Income Tax withheld for Pennsylvania.

- Report Local Taxable Gross Wages and Local Income Tax Withheld in Boxes 18 and 19 respectively.

- Ensure to include the 2 digit PSD code for your locality in Box 20 as per Act 32 of 2008.

- Review Box 14 for any additional deductions, such as retirement contributions and pre-tax benefits.

- Finally, verify your Social Security Number, Name, and Address on the form for accuracy before submitting.

- Once completed, you can save your changes, download, print, or share the form as needed.

Start filling out your PA W-2 Information online today to ensure accurate reporting of your earnings!

Yes, you need to attach copies of your W-2 forms to your PA tax return when you file. This includes all W-2s received for income earned during the tax year. By doing this, you provide evidence of your income and tax withholdings, which helps process your return efficiently. Ensuring you have complete PA W-2 information will facilitate a smoother filing experience and reduce the chance of audits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.