Get No Rf1209e 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NO RF1209E online

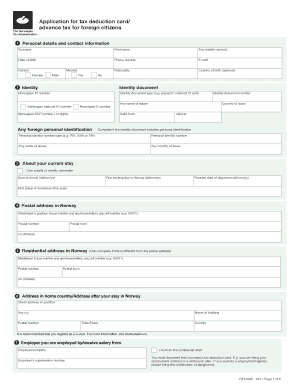

Filling out the NO RF1209E form online can simplify the process of applying for a tax deduction card or advance tax for foreign citizens. This guide provides detailed instructions on how to accurately complete each section of the form, ensuring that you have the necessary information submitted correctly.

Follow the steps to successfully complete the NO RF1209E form.

- Click the ‘Get Form’ button to access the NO RF1209E form and open it in your preferred digital editor.

- Personal details and contact information: Enter your surname, first name, any middle name(s), date of birth, phone number, email address, nationality, and optionally, your country of birth. Indicate your gender and marital status.

- Identity: Provide your Norwegian ID number, select the type of identity document (such as passport or national ID card), and fill in relevant details including the country of issue and validity dates.

- Current stay: Indicate if you are a daily or weekly commuter, and provide details such as your date of arrival, first working day, and expected date of departure.

- Postal address in Norway: Enter your full Norwegian postal address, including street/road name, house number, postal number, and town. Include a c/o address if necessary.

- Residential address in Norway: Only complete this section if your residential address is different from your postal address. Provide the necessary address details.

- Home country address: State your address in your home country or where you plan to go after your stay in Norway, including the street address, postal number, and town.

- Employer details: Fill in the name and organisation number of your employer or the company you received a job offer from. Indicate if you work on the Norwegian continental shelf.

- Income information: Provide your expected income in Norway this year, including any board fees or business income if applicable.

- Expenses: Indicate if your subsistence, lodging, and/or home visits abroad are covered by your employer by selecting the appropriate option.

- Date and signature: Finally, sign and date the form to confirm that all information provided is accurate before submitting it.

Complete your NO RF1209E application online today to ensure timely processing.

In Norway, tourists may be eligible for a tax rebate on specific purchases, designed to encourage spending. The rebate process often requires travelers to present receipts and complete the necessary paperwork. Understanding the NO RF1209E options can enhance your shopping experience and ensure you receive your entitled refund. US Legal Forms provides resources that simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.