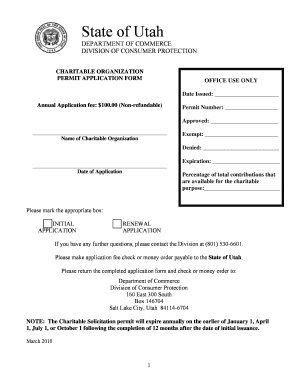

Get Ut Charitable Organization Permit Application Form 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT Charitable Organization Permit Application Form online

Completing the UT Charitable Organization Permit Application Form online is a crucial step for organizations seeking to operate legally in Utah. This guide will walk you through each section of the form, ensuring clarity and ease of completion for all users, regardless of their prior experience with legal documents.

Follow the steps to correctly complete the UT Charitable Organization Permit Application Form online.

- Use the ‘Get Form’ button to access the UT Charitable Organization Permit Application Form online and open it for editing.

- Begin with Part I, applicant's identification. Enter the name of your charitable organization, any other names used, and your organization's street address, including city, state, and zip code.

- Provide the contact details of your organization, including telephone number, email address, and facsimile number, ensuring accuracy for correspondence.

- Select the type of organization by marking the appropriate box, indicating your business structure. Be prepared to attach necessary documents such as the Articles of Incorporation.

- Identify a contact person within your organization and provide their phone number.

- Answer whether any organizations or individuals are affiliated with your organization, and if ‘yes’, provide the required details.

- Proceed to Part II if your organization is a parent foundation, providing requested information about local units and their registration.

- In Part III, disclose if you will use professionals for fundraising. If so, list their contact details and contract dates.

- For Part IV, provide information about any commercial co-venturers intended for use during charitable promotions.

- Move on to Part V, where you will describe the charitable purpose of your solicitation and how contributions will be used.

- In Part VI, supply financial information from your most recent IRS Form 990 or related forms as applicable.

- Complete Part VII by indicating the methods of solicitation you will use and the projected duration for each method.

- In Part VIII, respond about any injunctions or convictions affecting your organization.

- Submit the required documentation as listed in the application. This is important for your application's success.

- Finally, sign and date the application form. Ensure all information is accurate before submitting.

- Once all sections are completed, save the changes to your form, and proceed to download, print, or share it as necessary for submission.

Start your application today and ensure your organization is compliant with Utah regulations.

Get form

Typically, you do not need to issue a 1099 form for charitable donations, as these are not considered taxable income for the recipient. However, if the donation involves services or certain types of payments, different rules may apply. It's wise to refer to guidelines and potentially consult the UT Charitable Organization Permit Application Form for clarity on your obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.