Get Nebraska 1027 Exemption Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska 1027 exemption form online

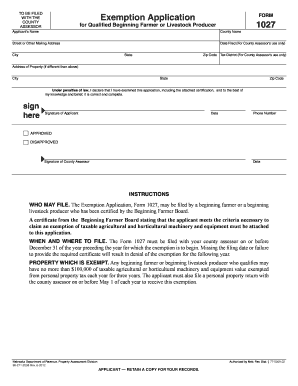

Filing the Nebraska 1027 exemption form is an important step for qualified beginning farmers and livestock producers seeking tax relief on agricultural and horticultural equipment. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to accurately complete your application.

- Click the ‘Get Form’ button to access the Nebraska 1027 exemption form and open it in an editable format.

- In the applicant’s name field, enter your full name as the person applying for the exemption.

- Fill in the county name where you are filing the form. This is important for proper routing to your local assessor's office.

- Provide your street or other mailing address, ensuring it is accurate for correspondence.

- Enter your city, state, and zip code in the designated fields to complete your address.

- Note the tax district, which is for the county assessor’s use only; ensure to leave this field blank.

- If the address of the property is different from your mailing address, provide that information here, including city, state, and zip code.

- Sign the declaration confirming the correctness of the application. Include the date of your signature.

- Include your phone number for contact purposes. This is critical in case the county assessor needs to reach you for clarification.

- After completing all fields, review the form for accuracy. Save your changes in the document, and ensure to keep a copy for your records.

- Finally, download the completed form, print it, or share it as necessary. Remember to file the form with your county assessor by December 31 of the year preceding the exemption year.

Complete the Nebraska 1027 exemption form online today and take advantage of the available tax exemptions!

In Nebraska, seniors may qualify for property tax exemptions based on their age and income level. Typically, residents aged 65 or older can apply for certain exemptions, including the Nebraska 1027 Exemption Form, which can help reduce their tax burden. It’s advisable for seniors to check with local tax authorities for specific eligibility requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.