Loading

Get Il Llc-5.30 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL LLC-5.30 online

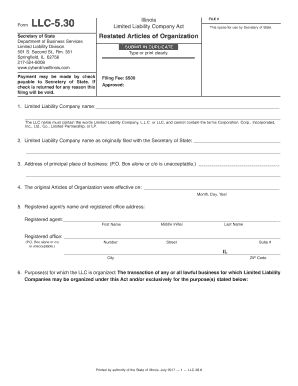

The IL LLC-5.30 form is essential for those looking to restate their articles of organization for a limited liability company in Illinois. This guide will walk you through the necessary steps to complete this form accurately and efficiently online.

Follow the steps to complete the IL LLC-5.30 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide the limited liability company name. Ensure the name includes 'Limited Liability Company', 'L.L.C.', or 'LLC', and does not have restricted terms like 'Corporation' or 'Inc.'.

- Enter the original limited liability company name as filed with the Secretary of State.

- Input the address of the principal place of business, ensuring a physical address is provided (P.O. Boxes are not acceptable). Include the county.

- Specify the date when the original Articles of Organization became effective using the appropriate month, day, and year format.

- Provide the registered agent's name, including middle initial, first name, and last name, followed by their registered office address. Ensure that this is a physical address.

- State the purpose(s) for which the LLC is organized. If additional space is needed, attach extra sheets.

- Indicate the latest date upon which the company is to dissolve if applicable. Leave blank for perpetual duration.

- Answer whether management is vested in managers or members and provide names and addresses as required.

- Affirm the information is correct and complete by signing the form and typing or printing your name and title. Include the company name if applicable.

- After completing all sections, save your changes. You can then download, print, or share the form as needed.

Complete your documents online today for a streamlined filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Involuntary dissolution happens when the state of Illinois decides to dissolve your LLC due to non-compliance, such as failing to file the Annual Report. This often results in the loss of business liability protection associated with your IL LLC-5.30. To prevent this situation, stay informed about filing deadlines and adhere to all state regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.