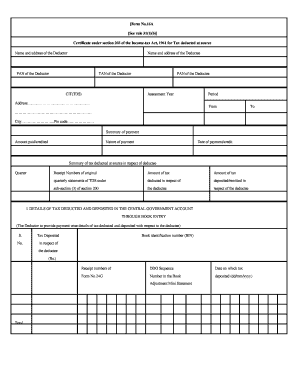

Get Form No 16a See Rule 311b Under Section 203

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form No 16a See Rule 311b Under Section 203 online

Filling out Form No 16a under Rule 311b of Section 203 is an essential step for reporting tax deducted at source. This guide provides clear and structured instructions to help users complete the form accurately and efficiently, ensuring compliance with tax regulations.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name and address of the Deductor in the designated fields. Ensure that both the legal name and the complete address are provided.

- Fill in the name and address of the Deductee. This is essential for identifying the recipient of the tax deduction.

- Indicate the period of payment by specifying 'From' and 'To' dates.

- Summarize the payment details by stating the amount paid or credited, the nature of the payment, and the date of payment or credit.

- Provide details of tax deducted and deposited in the Central Government account through book entry, including tax deposited amount, book identification number, and receipt numbers.

- In the verification section, certify that the information provided is complete and correct.

- Review all entered information for accuracy. After ensuring that everything is correct, save changes, download, print, or share the form as needed.

Start completing your Form No 16a online today to ensure your tax reporting is accurate and timely.

Section 203 of the Income Tax Act mandates the issuance of a tax deduction certificate when TDS is deducted. This section ensures that taxpayers receive a formal acknowledgment of the tax deducted at source, which helps in filing accurate income tax returns. Understanding this section is vital for both payers and payees to ensure compliance with tax regulations. Utilizing services like uslegalforms can provide further clarity and assistance in navigating these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.