Get Wi Uct 7842 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wi Uct 7842 online

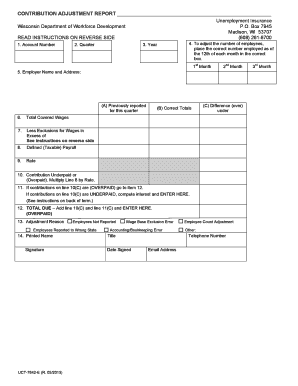

The Wi Uct 7842 is a crucial form used for adjusting previously reported quarterly contributions for unemployment insurance in Wisconsin. This guide provides a clear and detailed step-by-step approach to help users easily complete the form online, ensuring accuracy and compliance with regulations.

Follow the steps to successfully complete the Wi Uct 7842 form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your 10-digit Wisconsin UI account number in the Account Number field if it is not preprinted.

- Input the calendar quarter (1, 2, 3, or 4) in the Quarter field.

- Enter the applicable year in the Year field.

- If the reported number of employees for the month that included the 12th was incorrect, provide the correct number in the corresponding boxes for each month.

- Complete the Employer Name and Address section if it is not preprinted.

- In Column A, input the totals previously reported on the Quarterly Contribution Report or latest Contribution Adjustment Report.

- In Column B, enter the correct totals that should have been reported for this quarter.

- Calculate the difference between Column A and B in Column C. If Column A is greater, place that amount in brackets to indicate overreporting.

- Input the total covered wages paid during the quarter in item 6.

- For item 7, calculate the total wages exceeding the wage base and input that amount.

- Subtract item 7 from item 6 in item 8 and enter the result. Bracket if it is a decrease.

- Enter your tax rate in item 9.

- Multiply the amount from item 8 by your tax rate in item 10.

- If applicable, calculate interest on any underpayment for item 11.

- In item 12, add lines 10 and 11 and enter your total.

- Select the reason for the adjustment in item 13.

- In item 14, provide the printed name, title, telephone number, signature, date signed, and email address of the preparer.

- Once all fields are completed, save changes, download, print, or share the completed form as needed.

Begin completing your Wi Uct 7842 form online today to ensure accurate unemployment insurance reporting.

The unemployment tax rate in Wisconsin is determined by several factors, which include the employer's experience rating and the overall health of the unemployment trust fund. Generally, new employers may face a higher initial rate, while established employers benefit from lower rates. For precise calculations, you can utilize the resources available on uslegalforms to understand how Wi Uct 7842 influences your tax responsibilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.