Loading

Get Va Vec Fc-21 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VEC FC-21 online

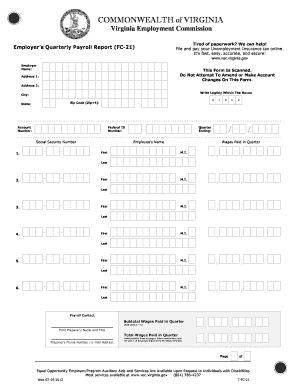

The VA VEC FC-21 form is essential for employers to report wages and employee count for unemployment insurance tax purposes. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to successfully complete the VA VEC FC-21 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your employer name clearly in the designated box. Ensure the information is printed legibly to avoid any processing issues.

- Provide your address by filling out Address 1 and Address 2, ensuring each section is completed appropriately.

- Enter the city, state, and zip code (including the Zip+4) in the respective fields.

- Input your account number and federal ID number accurately in the sections provided.

- Specify the quarter ending date by filling the month and year formats as instructed.

- List each employee’s name in the correct format on the form, along with the corresponding wages paid within the quarter. Ensure to include all necessary initials.

- Calculate the subtotal of wages paid in the quarter by adding the individual wages listed above.

- Review all entries for accuracy before proceeding to the final steps.

- Upon completing the form, save your changes, download a copy for your records, or print the form as needed.

Complete your VA VEC FC-21 form online to ensure compliance with unemployment insurance tax reporting.

If you need to talk to a live person at the Virginia Employment Commission, call their main customer service number during office hours. Be prepared to provide your information for quicker assistance. The staff is trained to handle inquiries regarding various aspects of unemployment, including VA VEC FC-21. They can provide the support you need during your interaction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.