Get Part Vii Of The First Schedcule

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PART VII OF THE FIRST SCHEDULE online

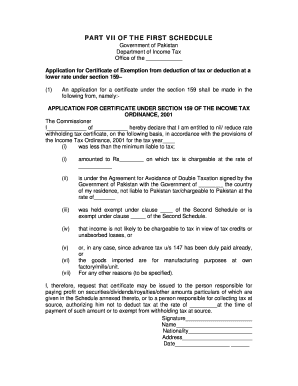

Filling out the Part VII of the First Schedule is a critical step for individuals seeking a certificate of exemption from tax deduction. This guide will provide comprehensive instructions on navigating the form effectively, ensuring accurate completion.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your name in the designated field where it says 'I___________ of ___________'. This should include your full name and the name of the entity, if applicable.

- Specify the tax year for which you are applying for the exemption in the space provided.

- In the next section, select the reason for the exemption by checking the appropriate basis for your application. You can choose from options such as income being less than the taxable amount or covered under a double taxation agreement.

- If applicable, fill in the amount pertaining to the taxable income and the applicable tax rate in the designated spaces.

- Provide information regarding any exemptions claimed by referring to the relevant clauses in the Second Schedule.

- Confirm your residency status in Pakistan by indicating 'resident' or 'non-resident' as applicable, then sign the form.

- Complete the remaining fields including your address, National Tax Number, and date of application at the end of the form.

- Review all entries for accuracy and completeness before saving your changes, downloading, printing, or sharing the form as necessary.

Complete your application online today for a smooth tax exemption process.

Schedule K-1 Part VII is a section that details the income, deductions, and credits for partners in a partnership or shareholders in an S Corporation. This information is essential for each partner or shareholder to accurately report their share of the business's income on their individual tax returns. Understanding the nuances of Schedule K-1 can help you avoid errors in your tax filings. For a comprehensive breakdown of this and related topics, check out the resources available on US Legal Forms, including information on PART VII OF THE FIRST SCHEDCULE.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.