Loading

Get Tx Ll-2a/ll-2 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX LL-2A/LL-2 online

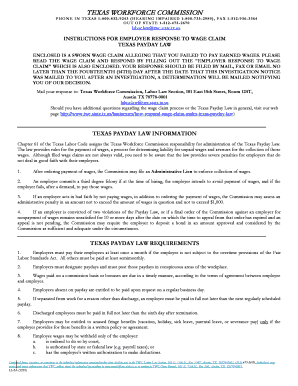

Filling out the TX LL-2A/LL-2 form correctly is essential for addressing wage claims efficiently. This guide aims to provide clear, step-by-step instructions for users to complete the form online, ensuring a smooth process for employers responding to wage claims in Texas.

Follow the steps to accurately complete the TX LL-2A/LL-2 online.

- Press the ‘Get Form’ button to access the TX LL-2A/LL-2 form. This will open the form in your online editor, ready for completion.

- Begin by filling out the employer information section. Provide your TWC (TEC) Account Number and enter the legal name of your business, address, and contact details.

- Indicate the classification of your business. Specify whether it is a sole proprietorship, partnership, or corporation by checking the appropriate boxes and providing the required information for partners or directors.

- Detail the claimant’s employment information. Enter the beginning date of the claimant's employment, their job title, and the current employment status.

- Next, fill out the wages claimed section. Provide the gross amounts associated with any claimed wages such as standards, commissions, overtime, and any deductions made.

- In the provided section, formulate your explanation if you believe any wage claims are incorrect. Be specific and align your responses to the respective claims.

- Finally, sign and date the form to certify that the information provided is true and accurate, then save your changes.

- Once completed, proceed to download, print, or share the form as necessary. Ensure the form is submitted to the Texas Workforce Commission within the specified timeframe.

Complete your TX LL-2A/LL-2 form online today to respond promptly to wage claims.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, Texas franchise tax is not considered a deductible tax on federal income tax returns. However, it is important to consult with a tax professional for personalized advice. Understanding the nuances of tax deductions can be facilitated by using the TX LL-2A/LL-2 feature to ensure compliance and discover available options.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.