Get Ny Db-136 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DB-136 online

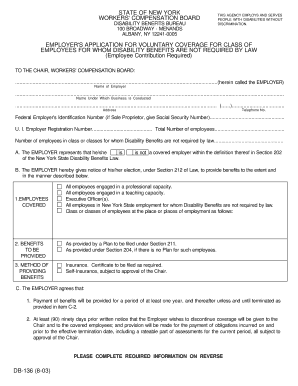

The NY DB-136 form is essential for employers in New York seeking voluntary coverage for employees not legally required to receive disability benefits. This guide will provide a comprehensive, step-by-step approach to filling out this form online, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the NY DB-136 form online.

- Click the ‘Get Form’ button to access the form and open it in your editing environment.

- Enter the name of the employer in the designated field. Ensure this is the official name that matches your business registration documents.

- Provide the name under which the business operates. This may differ from the employer's name, especially for corporations or LLCs.

- Fill in the business address, including the street, city, state, and ZIP code.

- Enter the telephone number for the business to ensure proper communication.

- Provide the Federal Employer's Identification Number (EIN). If you are a sole proprietor, input your Social Security Number instead.

- Include the Unemployment Insurance Employer Registration Number if applicable.

- State the total number of employees in your business.

- Indicate the number of employees in the class or classes for whom disability benefits are not mandated by law.

- In section A, confirm that the employer is not a covered employer according to the New York State Disability Benefits Law.

- In section B, specify which classes of employees will be covered under benefits. List all applicable classes.

- Outline the benefits to be provided as per your plan or Section 204.

- Select the method of providing benefits, indicating whether it is through insurance or self-insurance.

- In section C, agree to the terms regarding the payment of benefits, including the duration and termination notice.

- Certify that more than half of the employees in the class agree to contribute to the costs. Provide the details about their contributions.

- Ensure the form is signed and dated by an authorized official, confirming the accuracy of the provided information.

- If applicable, ensure the signatures of employee representatives are included, confirming their agreement to the contribution.

- Once all fields are completed accurately, save your changes. You may choose to download, print, or share the form as needed.

Complete and submit your NY DB-136 form online today to ensure your employees are covered!

To file a workers' compensation claim in New York State, start by notifying your employer about your injury or illness. Then, complete the required forms, including the necessary documents like the NY DB-136 if your situation qualifies as a disability claim. It’s important to submit everything timely to avoid delays. Platforms like USLegalForms can guide you through this process, ensuring you understand each step.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.