Get Ny C-72.1 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY C-72.1 online

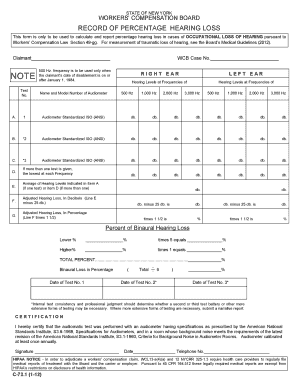

This guide provides clear, step-by-step instructions for completing the NY C-72.1 form, which reports percentage hearing loss in occupational cases. Designed for users with varying levels of experience, this guide aims to make the process straightforward and manageable.

Follow the steps to complete the NY C-72.1 form accurately.

- Press the ‘Get Form’ button to access the NY C-72.1 online document.

- In the form, begin by filling in the claimant's name in the designated field.

- Enter the WCB Case Number in the provided section to ensure proper identification of the claim.

- Record the hearing levels for both the right and left ears at the specified frequencies (500 Hz, 1,000 Hz, 2,000 Hz, and 3,000 Hz). Ensure you use the correct values based on the audiometric tests performed.

- Complete the Audiometer Information section by listing the name and model number of the audiometer used for the tests.

- If multiple tests were conducted, select the lowest hearing level at each frequency and input these values in the corresponding fields.

- Calculate the average of the hearing levels indicated and enter this figure in the designated area.

- Determine the Adjusted Hearing Loss in decibels by subtracting 25 db from the average hearing level and document this in the appropriate section.

- Calculate the Adjusted Hearing Loss in percentage by multiplying the adjusted hearing loss by 1.5 and record this value follow the instructions.

- Further assess the binaural hearing loss by following the calculations as outlined in the form, and tally the total percentage of hearing loss.

- In the certification section, provide your signature, the date of the test, and the telephone number for follow-up.

- Once you have filled out all required sections, you can save your changes, download the form, print it out, or share it as needed.

Complete the NY C-72.1 form online to ensure your claim is processed smoothly.

Winning a workers' comp hearing in New York often requires detailed documentation of your injury and its impact on your life. Present medical records, witness statements, and any evidence that supports your claim under NY C-72.1. Additionally, having legal representation can significantly increase your chances of success. A knowledgeable advocate can guide you through each step and help strengthen your case.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.