Loading

Get Nj Form 241 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form 241 online

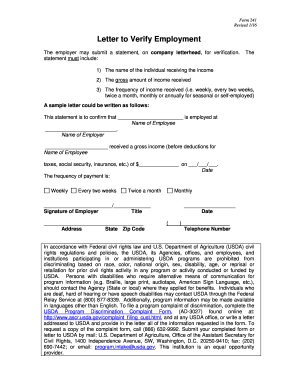

Filling out the NJ Form 241 online is a straightforward process that allows you to verify employment efficiently. This guide will walk you through each section and field of the form to ensure you complete it accurately and effectively.

Follow the steps to fill out the NJ Form 241 online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the individual receiving the income in the designated field.

- In the next field, specify the gross amount of income received for the individual listed above.

- Indicate the frequency of income received from the provided options: weekly, every two weeks, twice a month, monthly, or annually.

- Complete the sample letter format: write the name of the employer and ensure to include the gross income before deductions.

- Add the signature of the employer along with their title, address, and telephone number.

- Finally, review all entered information for accuracy. You can then save your changes, download, print, or share the completed form.

Start filling out your documents online today!

No, a 1040 form and a W-2 are not the same. The W-2 form reports wages and tax withholding from your employer, while the 1040 form is used to file your income tax return, incorporating information from the W-2. When filing your taxes, keep in mind that NJ Form 241 may also relate to your overall income reporting in New Jersey.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.