Loading

Get Il Per D 188.1 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL Per D 188.1 online

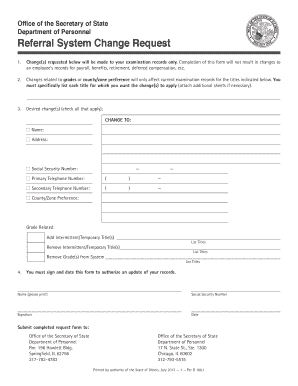

The IL Per D 188.1 form is designed for individuals wishing to request changes to their examination records. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring you can navigate the process with ease.

Follow the steps to complete your form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Read the instructions carefully at the top of the form to understand the scope of changes that can be made to your examination records.

- In Section 2, clearly list any specific titles for which you want to request changes. If you need more space, be sure to attach additional sheets.

- Move to Section 3, where you will indicate the desired changes by checking the appropriate boxes. You can request changes to your name, address, Social Security number, primary and secondary telephone numbers, and county/zone preference.

- If applicable, specify any changes related to intermittent or temporary titles by listing them in the designated areas. You can also remove grades from your system if needed.

- After filling in all required information, ensure that you sign and date the form in the provided spaces at the bottom.

- Once you have reviewed all entries for accuracy, save your changes, then download, print, or share the completed form as necessary.

Complete your IL Per D 188.1 form online today and streamline your request process.

Yes, you can file your Illinois state tax online through the Department of Revenue's website or an approved tax preparation service. Electronic filing is often faster and more efficient, making it easier to meet deadlines. Ensure you take into account IL Per D 188.1 during the electronic filing process to optimize your submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.