Get Ct Payroll Certification For Covered Service Worker Contracts 2005-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT Payroll Certification for Covered Service Worker Contracts online

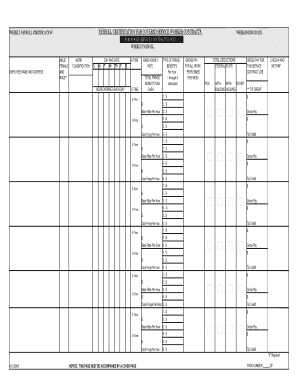

Filling out the CT Payroll Certification for Covered Service Worker Contracts is an essential step for employers to ensure compliance with labor regulations. This guide provides clear and detailed instructions on completing the form online, making the process straightforward for users of all experience levels.

Follow the steps to accurately complete the certification form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the week-ending date for the payroll period at the top of the form.

- For food service contracts, fill out the weekly payroll section detailing each employee's name and address.

- Complete the work classification fields by categorizing each employee's role.

- Document the hours worked each day for every employee in the designated columns.

- Fill out the base hourly rate and calculate both the total earnings for the week and total deductions.

- Specify the type of fringe benefits provided to each employee.

- Complete the certified statement of compliance section.

- Review the entire form for accuracy before saving.

- Once completed, save changes, download, print, or share the form as necessary.

Start completing your documents online to ensure timely compliance.

To manage payroll for 1099 employees, you should prepare and issue IRS Form 1099-MISC to report payments made throughout the year. It is essential to maintain accurate records of all payments and ensure compliance with the CT Payroll Certification for Covered Service Worker Contracts when necessary. Consulting a platform like uslegalforms can provide valuable resources for managing these aspects effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.