Get Ca Edd De 9adj-i 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA EDD DE 9ADJ-I online

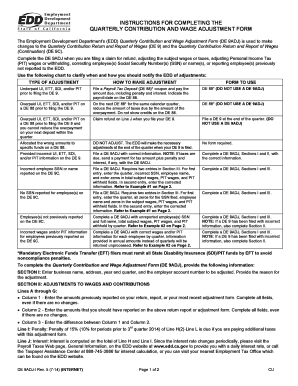

The California Employment Development Department (EDD) Quarterly Contribution and Wage Adjustment Form (DE 9ADJ) allows users to make necessary adjustments to their tax filings. Filling out this form correctly is crucial for ensuring accurate reporting of wages and contributions.

Follow the steps to accurately fill out the CA EDD DE 9ADJ-I online.

- Use the ‘Get Form’ button to access the form and open it in your preferred platform.

- Section I: Enter your business name, address, the applicable year and quarter, and the employer account number that requires adjustment. Clearly state the reason for the adjustment.

- Section II: Adjustments to wages and contributions. Lines A through G: In Column 1, enter the amounts previously reported. In Column 2, enter the amounts that should have been reported. In Column 3, calculate the difference between Column 1 and Column 2.

- Line I: If applicable, enter any penalties incurred for additional taxes due from the adjustment. Calculate this as 15% of Line H(2) minus Line L.

- Line J: Compute any interest applicable on the total from Line H and Line I. Refer to the EDD website for the current interest rate.

- Line K: If there were erroneous State Disability Insurance deductions not refunded, indicate this. Note that these must be refunded to employees before any adjustments can proceed.

- Line L: Enter your total contributions and withholdings paid for the quarter.

- Line M: Calculate the total due by adding Subtotal (Line H2), Penalty (Line I), Interest (Line J), and Erroneous SDI Deductions Not Refunded (Line K), then subtract Line L. Pay any balance due.

- If adjustments affect information previously reported on DE 9C, complete Section III. Provide necessary details for each employee, ensuring you do not report negative amounts.

- Finally, sign the form in the designated area, adding your title, phone number, and date. Ensure your signature is included, as requests for refunds or credits will not be processed without it.

Start filling out your CA EDD DE 9ADJ-I online today to ensure accurate and timely adjustments.

Get form

To correct a DE9 form, you’ll need to provide the correct information and submit it as soon as possible. It’s important to follow the guidelines set by the California Employment Development Department to avoid potential penalties. Utilizing the CA EDD DE 9ADJ-I can enhance your correction process, ensuring all adjustments are compliant. For additional help, UsLegalForms can guide you through making these corrections efficiently.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.