Loading

Get Ar Dws-ark-209 Bsi 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DWS-ARK-209 BSI online

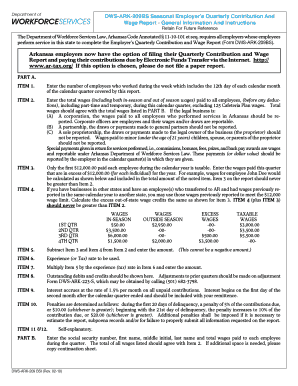

The AR DWS-ARK-209 BSI form is essential for Arkansas employers to report their quarterly employee wages and contributions. Completing this form accurately ensures compliance with state regulations and supports effective document management.

Follow the steps to accurately complete the AR DWS-ARK-209 BSI form online.

- Click the ‘Get Form’ button to obtain the form and access it in your chosen online editor.

- In PART A, ITEM 1, input the number of employees who worked during the week that includes the 12th day of the month for the calendar quarter you are reporting.

- In ITEM 2, enter the total wages paid to all employees during the quarter, ensuring to include both in-season and out-of-season wages. Be mindful to exclude any Cafeteria Plan wages.

- For ITEM 3 and ITEM 4, calculate and report any wages exceeding the $12,000 annual taxable limit per employee based on the provided calculations within the form.

- In ITEM 5, subtract the amounts from ITEM 3 and ITEM 4 from ITEM 2. Ensure this amount is not negative.

- Specify your experience (or tax) rate in ITEM 6.

- For ITEM 7, multiply the amount from ITEM 5 by the tax rate indicated in ITEM 6, then record the result.

- ITEM 8 is for debts and credits; enter any outstanding amounts that apply. Adjustments from prior quarters must be submitted on Form DWS-ARK-223-S.

- In ITEM 9, note that interest on unpaid contributions starts accruing at 1.5% per month after the two-month grace period post-quarter.

- Review ITEM 10 for penalties related to delinquency. These are tiered based on the length of time the contributions are overdue.

- In PART B, enter the social security number, first name, middle initial, last name, and total wages paid to each employee during the quarter. Verify that the total matches ITEM 2.

- Once all entries are complete, confirm your accuracy, then make choices to save changes, download, print, or share the form as needed.

Begin completing your documents online today for hassle-free filing.

Employers are primarily responsible for paying unemployment insurance in Arkansas through mandated tax contributions. This funding ultimately supports workers during periods of unemployment. Understanding the responsibilities established under the AR DWS-ARK-209 BSI is crucial for both employees seeking benefits and employers who are funding the program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.