Loading

Get Car Leasing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Car Leasing online

Filling out a car leasing application online can be a straightforward process if you approach it step by step. This guide will walk you through each section of the form, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete your Car Leasing application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

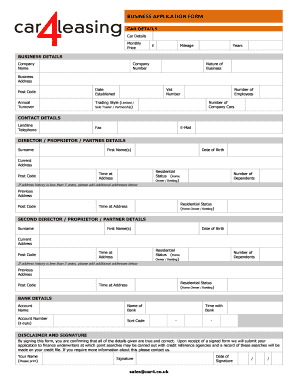

- In the car details section, enter the monthly price of the car you wish to lease. Specify the estimated mileage and the length of the lease term in years.

- Fill in your business details, including the company name, registration number, nature of business, and business address along with the postcode. Also, provide the date the business was established, VAT number, and annual turnover.

- Indicate the trading style of your business (Limited, Sole Trader, or Partnership) and the number of employees and company cars.

- Provide contact details including a landline telephone number, fax number (if applicable), and your email address.

- For the director, proprietor, or partner details, enter the surname, first name(s), date of birth, current address, and postcode. Indicate the residential status (Home Owner or Renting) and provide how long you have been at that address along with the number of dependents.

- If your address history is less than five years, list any previous addresses along with their postcodes, residential status, and duration of residence.

- If applicable, repeat the process for a second director, proprietor, or partner, providing the required personal details.

- In the bank details section, enter the account name, bank name, account number (8 digits), sort code, and how long you have had an account with the bank.

- Review the disclaimer and signature section carefully. By signing the form, you confirm that all details are true and correct. Print your name, provide your signature, and date it before submitting.

- After filling out the form, you can save changes, download, print, or share the completed document as needed.

Start your car leasing application online today!

Leasing a car can be a smart choice for many drivers. It allows you to enjoy a new vehicle every few years without the long-term commitment of ownership. Additionally, car leasing often results in lower monthly payments compared to purchasing a car outright. For those who prefer driving the latest models and maintaining lower maintenance costs, car leasing provides an attractive solution.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.