Loading

Get Tx H-15 1993-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX H-15 online

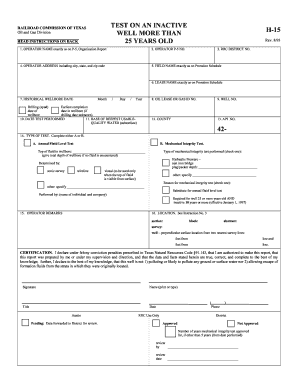

The TX H-15 form is essential for reporting the status of an inactive well that is over 25 years old. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the TX H-15 form online.

- Click ‘Get Form’ button to access the TX H-15 online and open it in your preferred document editor.

- In section 1, enter the operator name exactly as it appears on the P-5 Organization Report.

- Input the operator P-5 number in section 2.

- Fill in the RRC district number in section 3.

- Provide the operator address in section 4, including the city, state, and zip code.

- Indicate the field name exactly as noted on the Proration Schedule in section 5.

- In section 6, enter the lease name as it appears on the Proration Schedule.

- For section 7, input the historical wellbore date with the month, day, and year. If the drilling date is unknown, provide the earliest completion date.

- Fill in the date the test was performed in section 10.

- In section 11, specify the base of the deepest usable quality water (subsurface).

- Complete section 12 by entering the county information.

- Provide the API number in section 13.

- In section 14, indicate the type of test conducted, either A or B. Specify the type of mechanical integrity test performed and the determiner.

- Add any operator remarks in section 15, if necessary.

- For section 16, provide detailed location information as per Instruction No. 3.

- Finally, complete the certification section by signing, typing your name, title, and the date.

- Once finished, you can save changes, download, print, or share the completed form as needed.

Get started now and fill out your TX H-15 form online for a smooth filing experience.

Estimated total income in Form 15H refers to the total income you anticipate earning in a financial year, including salary, interest, and any other sources of income. This estimation is crucial as it determines whether you qualify for submitting the TX H-15 and helps ensure you are not subject to tax deductions at source. Therefore, accurately calculating this amount can lead to significant financial benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.