Get Wisconsin 2014 1npr Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin 2014 1npr Form online

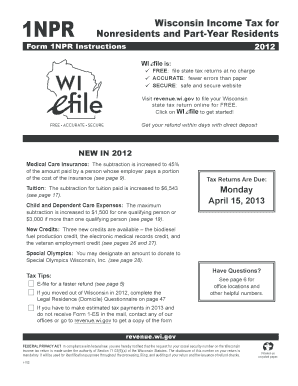

Filling out the Wisconsin 2014 1npr Form online is an essential process for nonresidents and part-year residents to report their income accurately. This guide offers user-friendly, step-by-step instructions to ensure that you complete the form correctly and efficiently.

Follow the steps to fill out your Wisconsin 2014 1npr Form online.

- Click the ‘Get Form’ button to obtain the Wisconsin 2014 1npr Form. This action will open the form in your online editor for filling out.

- Enter your legal name and address in the designated fields at the top of the form. Ensure to include your apartment number if applicable.

- Provide your social security number in the appropriate field. If you are filing jointly, make sure to include your spouse's information as well.

- Indicate your filing status by checking the appropriate box, such as single, married filing jointly, or married filing separately.

- Fill out your income information in the corresponding sections, ensuring to differentiate between Wisconsin-source income and income from other locations.

- Complete the modifications section as necessary, reporting any differences between federal and Wisconsin income by using the notes and supplementary schedules as needed.

- Ensure to check for any applicable credits and deductions, filling these in according to the guidance provided on the form, such as tuition, medical care insurance, or dependent care credits.

- Review the completed form for any errors or omissions before saving your changes. Make sure all required fields are filled out accurately.

- Once you have completed the form, you can save your changes and then choose to download, print, or share your Wisconsin 2014 1npr Form as needed.

Take the first step and get started by filling out your Wisconsin 2014 1npr Form online!

You can find paper tax forms at various locations, including the Wisconsin Department of Revenue offices, public libraries, and tax assistance centers. Many people also prefer to order forms online and have them mailed to their homes. If you need specific forms like the Wisconsin 2014 1NPR Form, consider using the US Legal Forms platform, where you can easily access, print, and fill out any required documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.