Loading

Get Ny Tc-03 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY TC-03 online

Filling out the NY TC-03 form for parking permits for persons with disabilities can be straightforward if you follow the right steps. This guide provides a clear and comprehensive walkthrough to ensure you complete the form correctly and efficiently.

Follow the steps to complete the application process seamlessly.

- Click ‘Get Form’ button to access the application form and open it in your browser.

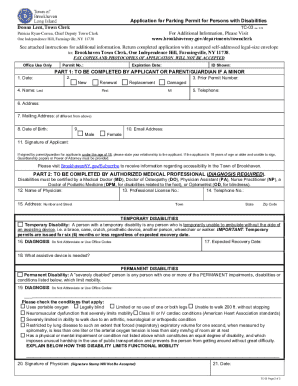

- In Part I of the application, select the type of application you are submitting by marking the appropriate box: New, Renewal, Replacement, or Damaged. Enter the date and your name, including the last name, first name, and middle initial.

- Provide your prior permit number, if applicable, and enter your telephone number. Next, fill in your address. If your mailing address is different, include that information as well.

- Enter your date of birth, choose your gender, and provide your email address. Ensure that your signature is included. If a parent or guardian signs for a minor, they should detail their relationship to the applicant.

- In Part II, your physician must complete this section. They should provide their name, professional license number, and telephone number. The physician's address is also required.

- Detailed information regarding the disability must be provided. The physician must specify the diagnosis without using abbreviations and include an expected recovery date if applicable.

- For temporary disabilities, indicate the assistive device required. For permanent disabilities, check the appropriate conditions that apply and explain how the disability limits functional mobility.

- Finally, your physician needs to sign and date the form. Remember, signature stamps are not acceptable.

- Once completed, return the application by mail or in person to the Town Clerk's office. Do not submit fax copies or photocopies.

- After submitting the form, you may want to save a local copy, download, print, or share the application for your records.

Start filling out your NY TC-03 form online today to ensure you receive your parking permit promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out the employee withholding tax exemption certificate requires you to clearly indicate your qualification for tax exemption. Provide accurate and detailed information regarding your financial situation and reasons for exemption. Resources like the uslegalforms platform can simplify this process while guiding you on relevant NY TC-03 aspects.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.