Loading

Get Mi Form Cts-06 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Form CTS-06 online

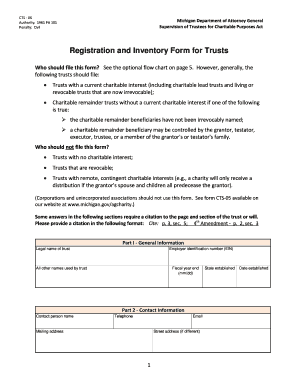

Filling out the MI Form CTS-06 online is a crucial step for trusts with a charitable interest. This comprehensive guide will walk you through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to successfully complete the MI Form CTS-06 online.

- Press the ‘Get Form’ button to access the online form and open it in the designated editor.

- Provide general information in Part I. Fill in the legal name of the trust, its employer identification number (EIN), any other names used by the trust, and the fiscal year end date (mm/dd).

- Move to Part II, which requires contact information. Enter the contact person's name, telephone number, email address, and both mailing and street addresses if different.

- In Part III, list the names and addresses of all trustees. If you need more space, ensure to attach a separate sheet.

- Part IV relates to the IRS status and return. Check the appropriate box for the trust's IRS status, whether it has received, will apply for, or will not obtain tax-exempt status. Additionally, specify the type of IRS return filed.

- In Part V, provide information on how the trust was created. Note any relevant documentation such as trust agreements or court orders and answer whether a probate file has been opened.

- Part VI requires details about the charitable purpose beneficiaries. Check the applicable options, list all current and future charitable beneficiaries, and specify when distributions will be made.

- Complete Part VII by providing a financial report. Indicate the type of report submitted and ensure it includes necessary details like receipts and disbursements.

- In Part VIII, if no financial report is available, list all assets and liabilities with respective valuations, ensuring correct totals are provided.

- Review the attachments required in Part IX. Ensure to include documents as specified, such as trust agreements, IRS letters, and financial reports.

- Finally, in Part X, certify the information by signing, dating, and printing your name and title. Review all sections to confirm accuracy before submission.

- Upon completion, you can download, print, or share the form as needed. Return the completed form via email or mail to the Michigan Department of Attorney General.

Complete the MI Form CTS-06 online to ensure your trust complies with state requirements.

The Charitable Solicitation Act in Michigan regulates fundraising activities to protect donors and ensure fair practices. This act sets forth the requirements for registration and oversight of charitable organizations. To comply, organizations often need to obtain and submit the MI Form CTS-06.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.