Get Il Ptax-343-r 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL PTAX-343-R online

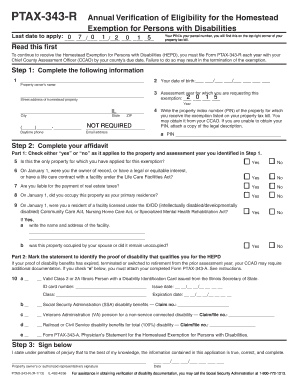

This guide provides step-by-step instructions on how to complete the IL PTAX-343-R form, essential for applicants seeking the Homestead Exemption for Persons with Disabilities. Ensuring accurate completion is crucial to maintain your exemption status.

Follow the steps to successfully complete the IL PTAX-343-R.

- Click ‘Get Form’ button to access the IL PTAX-343-R and open it for editing.

- Provide your personal information. Start by entering your name, followed by your date of birth in the specified format. Next, indicate the assessment year for which the exemption is being requested.

- Identify the property by entering the property index number (PIN), which can be found on your property tax bill, along with your daytime phone number and email address.

- Complete your affidavit by answering the questions in Part 1. For each question about property ownership, occupancy, and liability for real estate taxes, indicate 'Yes' or 'No' as applicable.

- In Part 2, mark the statement that indicates which proof of disability qualifies you for the Homestead Exemption. Fill in the necessary details if you own or need to attach additional documentation.

- Sign the form, certifying that the information is true to the best of your knowledge. Make sure to include the date of signing.

- Once all sections are complete, you can save changes to the form, download it, print it for mailing, or share it as needed. Ensure you keep a copy for your records.

Complete your documents online to ensure your Homestead Exemption benefits continue uninterrupted.

Get form

In Illinois, a homeowner's exemption can save you a substantial amount on property taxes, typically reducing the assessed value of your home by about $10,000. This exemption is particularly beneficial when combined with forms like the IL PTAX-343-R, as it maximizes your savings. Consider visiting US Legal Forms to learn more about additional savings opportunities related to property tax exemptions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.