Loading

Get Il Ptax-343-r 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL PTAX-343-R online

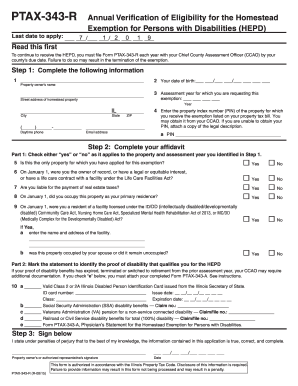

Completing the IL PTAX-343-R is essential for individuals seeking to maintain their Homestead Exemption for Persons with Disabilities. This guide provides a detailed, user-friendly walkthrough to facilitate the online completion of this important form.

Follow the steps to successfully fill out the IL PTAX-343-R

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information in the following fields: your full name as the property owner, the street address of your homestead property, your date of birth, and the assessment year for the exemption request.

- Enter the property index number (PIN), which can be found on your property tax bill or by contacting your Chief County Assessment Officer (CCAO). If the PIN is unavailable, attach the legal description of the property.

- Provide your daytime phone number and email address for any correspondence related to your application.

- Complete the affidavit by answering the yes/no questions regarding your eligibility and ownership of the property as of January 1 of the assessment year.

- Indicate the proof of disability in accordance with the options available and provide necessary identification numbers and dates as required.

- Sign and date the form to declare that all provided information is true and complete.

- Final review: Save the changes made to the form, and prepare to download, print, or share it with your CCAO to ensure timely submission before the due date.

Complete your IL PTAX-343-R online now and ensure you maintain your exemption status.

To apply for a senior citizen exemption in Cook County, you need to complete the necessary application form and provide proof of age and residency. Submitting your application before the deadline is crucial to receive the exemption for the assessment year. For more assistance, consult IL PTAX-343-R for step-by-step guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.