Loading

Get Il Loan Broker Borrower Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL Loan Broker Borrower Statement online

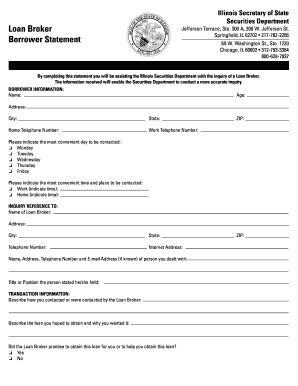

Filling out the IL Loan Broker Borrower Statement is an important step in assisting the Illinois Securities Department with inquiries regarding loan brokers. This guide provides clear direction to help individuals navigate the form efficiently and effectively.

Follow the steps to complete the IL Loan Broker Borrower Statement

- Click ‘Get Form’ button to access the IL Loan Broker Borrower Statement online and open it in your preferred editor.

- Begin by filling out the 'Borrower Information' section. Provide your full name, age, address, city, state, home and work telephone numbers, and ZIP code.

- Indicate your preferred contact day by checking the corresponding box for Monday through Friday. Then, specify the most suitable time and location for a representative to reach you.

- In the 'Inquiry Reference To' section, enter the name and contact details for the loan broker you are inquiring about, including their address, city, state, telephone number, and internet address.

- Input the name, address, telephone number, and email address (if known) of the person with whom you interacted during the loan process. Additionally, include the title or position that person claimed to hold.

- In the 'Transaction Information' section, describe how you initially contacted the loan broker, and the type of loan you wanted, along with the reasons for your request.

- Answer whether the loan broker promised to secure the loan for you or assist in the process by selecting 'Yes' or 'No.'

- Indicate if you signed a contract for the loan broker's services and, if so, provide the date of signing.

- Confirm whether you received a written description of the services prior to signing or making any payments. If applicable, provide the date this was received.

- Answer if you paid any fees to the loan broker prior to receiving a binding commitment for the loan, affirming if the payment was meant for out-of-pocket expenses, and detail the fee amount, date paid, and payment method.

- In the 'Miscellaneous' section, indicate if you have filed any complaints or inquiries with other agencies and provide details if applicable.

- Select whether you have obtained legal counsel and provide the attorney's contact information if applicable.

- Attach copies of relevant documents as requested, including canceled checks or payment evidence.

- Indicate your willingness to be interviewed by a Securities Department investigator and whether you are prepared to testify if needed.

- Provide any additional information that may aid the Securities Department in understanding your agreement with the loan broker.

- Finally, sign the document and include the date of signing.

Complete your IL Loan Broker Borrower Statement online now for a swift and efficient process.

An application for registration must be filed with the Secretary of State on Illinois Form IL LB15-10, Application to Register as a Loan Broker in the State of Illinois, along with Illinois Form LB15, Consent to Service of Process (if not incorporated or authorized to transact business in Illinois), the disclosure ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.