Loading

Get Co Form 100 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO Form 100 online

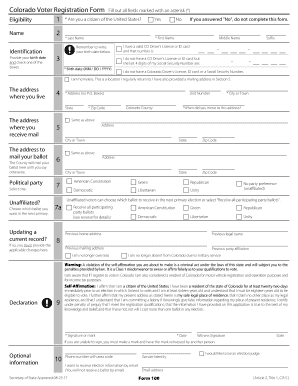

Filling out the CO Form 100 online is a straightforward process that allows residents of Colorado to register to vote efficiently. This user-friendly guide will walk you through each section of the form, ensuring you complete it accurately and understand its requirements.

Follow the steps to successfully register to vote online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the eligibility questions. Confirm your citizenship status by answering "Yes" or "No" to the question if you are a citizen of the United States.

- In the Name section, provide your first name, middle name (if applicable), last name, and suffix, if any.

- Enter your date of birth in the format MM/DD/YYYY.

- If you have a valid Colorado Driver's License or ID card, enter the number. If not, provide the last four digits of your Social Security Number or indicate if you do not possess either.

- Fill in your residential address without using a P.O. Box. Include your state, city or town, and zip code.

- For mail delivery, enter your mailing address if it differs from your residential address. Complete the required fields for the city or town and zip code.

- Select your political party affiliation or indicate if you are unaffiliated. Choose your preference for participation in future primaries if applicable.

- Provide information about your previous address, if you have moved, or any previous party affiliation. This step is essential for updating any existing records.

- Read and understand the self-affirmation, then sign and date the form. If you cannot sign, make a mark and have it witnessed.

- Enter any optional information, such as your phone number, gender identity, and email address for receiving election information.

- Finally, save your changes, download the completed form, and prepare to submit it according to the instructions provided.

Complete your voter registration form online today to ensure your voice is heard in upcoming elections.

To obtain a refund reissue letter in Colorado, you must contact the Colorado Department of Revenue directly. Provide your identification details and the reason for the request. Utilizing the CO Form 100 correctly can help support your claim and streamline the process of getting your refund reissued.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.