Get Il Cft 23.13 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CFT 23.13 online

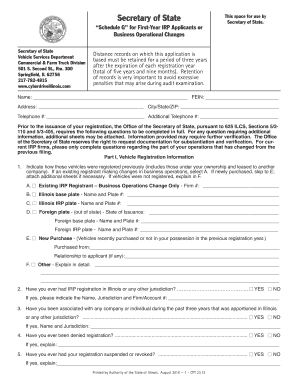

The IL CFT 23.13 form is essential for individuals and businesses applying for vehicle registration under the International Registration Plan. This guide provides clear, step-by-step instructions on how to efficiently fill out this form online, ensuring all necessary information is accurately submitted.

Follow the steps to fill out the IL CFT 23.13 form online:

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your name and Federal Employer Identification Number (FEIN) in the designated fields.

- Fill out your address, including city, state, and ZIP code, as well as your primary and additional telephone numbers.

- In Part I, select how the vehicles were registered previously by checking the appropriate box. If applicable, fill in the firm number or details about prior registrations.

- Answer the questions regarding previous IRP registration and associations with other companies in Part I, making sure to provide information as required.

- For Part II, indicate your business type by checking the relevant box and provide the necessary details about ownership and associated individuals.

- Complete all questions concerning USDOT information and business plans in Parts IV and V, ensuring to give detailed explanations where required.

- In Part VI, affirm the correctness of the information provided by signing and dating the appropriate sections.

- Once all sections of the form are filled out correctly, review your entries for any errors or omissions.

- Save your changes, and then download, print, or share the completed form as necessary.

Ensure you complete the IL CFT 23.13 form online to facilitate your vehicle registration process.

If you earn income in Illinois but are a non-resident, you are generally required to file a non-resident tax return. This ensures compliance with state tax laws and helps clarify your tax responsibilities. Understanding IL CFT 23.13 can provide guidance on filing correctly. Ensure you keep good records of your Illinois income to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.