Loading

Get Il Cdts-25.3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL CDTS-25.3 online

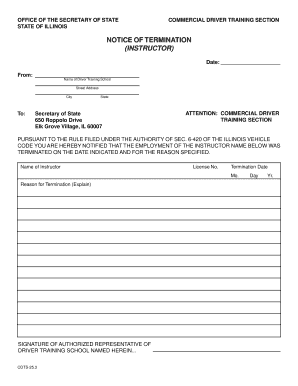

The IL CDTS-25.3 is an important form used to notify the Secretary of State of the termination of an instructor in a driver training program. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the IL CDTS-25.3 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the driver training school and the corresponding street address in the designated fields.

- Enter the city and state where the driver training school is located.

- In the provided section, write the name of the instructor whose employment is being terminated.

- Input the instructor's license number accurately as it appears on their credentials.

- Specify the termination date, ensuring to fill in the month, day, and year correctly.

- Explain the reason for termination in the designated area, providing clear and concise details.

- Once all fields are completed, ensure to have the signature of an authorized representative from the driver training school in the appropriate section.

- After verifying all information is correct, you can save changes, download, print, or share the completed form.

Complete your documents online now to ensure timely processing.

Making a payment to the state of Illinois can be done through various methods, including electronic payment options or by mailing a check. Ensure that you include the correct information and reference IL CDTS-25.3 to ensure your payment is processed efficiently. Check the Illinois Department of Revenue website for specific payment options and instructions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.