Get Ct P-225 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT P-225 online

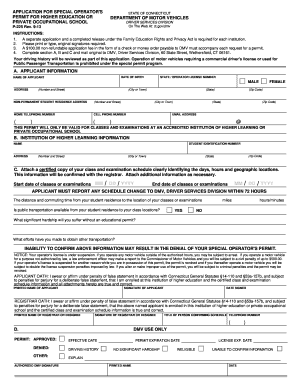

Filling out the CT P-225, the application for a special operator's permit for higher education or private occupational school, is a crucial step for individuals seeking educational opportunities while navigating license suspensions. This guide will lead you through the process with clear, concise instructions.

Follow the steps to complete the CT P-225 online.

- Click the ‘Get Form’ button to access the CT P-225 application. You will open this form in the designated online editor.

- Begin by filling out section A, which includes your applicant information. Provide your state or operator license number, date of birth, and full name. Indicate your gender by selecting either 'Male' or 'Female' and fill in your address, including the city, state, and zip code. If applicable, also include your non-permanent student residence address.

- Next, fill in your home and cell phone numbers, along with your email address. Ensure all this information is accurate as it will be used for communication regarding your application.

- Proceed to section B to provide the institution of higher learning information. Enter the name of your educational institution, your student identification number, and the institution's address including the city, state, and zip code.

- In section C, attach a certified copy of your class and examination schedule. This document should clearly specify the days, hours, and geographic locations of your classes. Include the start and end dates of your classes or examinations.

- Indicate the distance and commuting time from your student residence to your classes or exam sites in miles and hours/minutes. Also, specify whether public transportation is available.

- Provide details regarding any significant hardship you may face without the educational permit, along with efforts you have made to secure alternative transportation.

- Review all entered information thoroughly. Scroll to the applicant and registrar oaths section, where you will need to print your name, date signed, and provide your signature at the designated area.

- After completing the form, save your changes and options to download or print the document for mailing. Ensure that you send the original application to DMV, Driver Services Division at the specified address.

Complete your application for the CT P-225 online today for a smoother process.

CT P-225 is a form related to the various tax deductions available for small businesses in Connecticut. By filing this form, you can optimize your tax responsibilities and ensure compliance with state tax regulations. Understanding how to effectively utilize CT P-225 can enhance your overall financial strategy and maximize the benefits your business receives during tax season.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.