Loading

Get Tx Fin503 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX FIN503 online

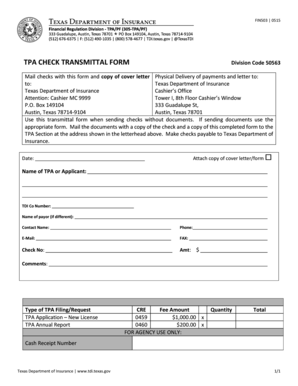

The TX FIN503 form, known as the TPA check transmittal form, is essential for submitting checks to the Texas Department of Insurance. This guide provides clear and step-by-step instructions on how to accurately complete this form online.

Follow the steps to fill out the TX FIN503 effectively.

- Press the 'Get Form' button to acquire the TX FIN503 form and launch it in the editing interface.

- Begin by filling out the 'Date' field with the current date when you are completing the form.

- Enter the name of the TPA (Third Party Administrator) or applicant in the provided section.

- Input the TDI Co Number, which is necessary for identification purposes.

- If applicable, provide the name of the payor in the designated area. If the payor is the same as the TPA/applicant, you can leave this blank.

- Fill in the contact name, phone number, e-mail address, and fax number in their respective sections to ensure communication.

- Record the check number relevant to your payment in the 'Check No' section.

- Indicate the amount of the check in the 'Amt: $' field, ensuring that you enter it in a standard dollar format.

- Use the comments section for any relevant notes or special requests related to your submission.

- Select the type of TPA filing or request from the available options and denote any applicable fees by marking the boxes.

- Calculate and enter the total fee amount based on your selections.

- After completing all sections, review the form for accuracy. Once satisfied, save your changes, then download, print, or share the TX FIN503 as needed.

Complete the TX FIN503 form online today for a seamless filing experience.

The $7,000 government grant for students often refers to the maximum funding available through certain federal programs. It aims to help reduce out-of-pocket education expenses. To qualify, you typically must demonstrate significant financial need, as assessed through your FAFSA application. For clarity on how these grants intersect with TX FIN503 benefits, consider exploring the resources available on the US Legal Forms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.