Get Tx Dads 5006 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX DADS 5006 online

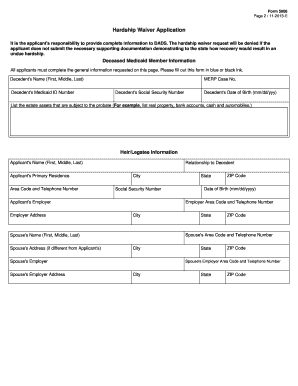

The TX DADS 5006 is a hardship waiver application form provided by the Texas Department of Aging and Disability Services. It allows individuals to request a waiver of the Medicaid estate recovery claim when recovery would impose an undue hardship. This guide offers a clear, step-by-step approach to completing the form online, ensuring that users understand each section and field required for submission.

Follow the steps to successfully complete the TX DADS 5006 online.

- Click the ‘Get Form’ button to obtain the form and access it in your online editor.

- Begin with the deceased Medicaid member's information section. Include the decedent's name, Medicaid ID number, social security number, date of birth, and a list of estate assets that are subject to probate.

- Next, complete the heir/legatee information. This includes the applicant's name, address, contact information, social security number, and details regarding their employer and relationship to the decedent.

- Proceed to Section I, where you will answer questions confirming if the estate property has been a family business, farm, or ranch for at least 12 months and provide a description along with supporting documents.

- In Section II, indicate whether you would become eligible for public assistance if the estate claim were collected. Explain your circumstances and provide any required documentation.

- Continue to Section III, answering whether you would be able to discontinue public assistance if the claim were not collected. Document the types of public assistance you receive.

- Complete Section IV, which addresses whether the decedent received Medicaid due to being a crime victim, providing details and documentation if applicable.

- Move to Section V, where you can detail any other compelling reasons that may support your hardship claim, providing documentation as necessary.

- In Section VI, provide information regarding the homestead exemption qualifications, detailing the number of heirs and the appraisal district value of the homestead.

- Finally, review the entire application for completeness and accuracy, ensure all required supporting documents are attached, and then save changes, download, print, or share the completed application as needed.

Take the first step and complete your TX DADS 5006 online today!

Related links form

To protect your assets from Medicaid recovery in Texas, start by exploring the options outlined in TX DADS 5006. Establishing a revocable living trust can safeguard your assets while allowing you to retain control. Additionally, gifting assets, with careful timing, can help shield them from recovery efforts. Consulting with our platform, USLegalForms, can provide you access to necessary forms and resources to facilitate this process smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.