Get Ny A-9k 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY A-9K online

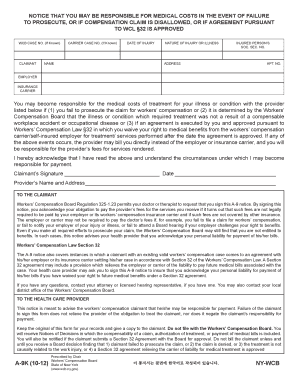

The NY A-9K form is a crucial document used to inform claimants of their potential responsibility for medical costs related to workers' compensation claims. This guide provides comprehensive, step-by-step instructions on how to accurately complete this form online, ensuring that users understand each section and its implications.

Follow the steps to fill out the NY A-9K form online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'WCB Case No.' field, enter the case number if you know it. This identifies your specific claim.

- Fill in the 'Claimant' section with your full name as the individual who is making the claim.

- If available, enter the 'Carrier Case No.' which corresponds to your insurance provider's reference.

- Provide the 'Date of Injury' to indicate when the incident occurred.

- Specify the 'Nature of Injury or Illness,' clearly detailing the condition that required medical attention.

- Complete the 'Address' section with your current residential address.

- Input the 'Injured Person’s Social Security Number.' This information is necessary for identification purposes.

- If applicable, include the 'Apartment No.' to ensure your address is complete.

- In the 'Employer' section, enter the name of the employer associated with the claim.

- Fill in the 'Insurance Carrier' field, indicating the name of the insurance company handling the workers’ compensation.

- Review all entries for accuracy to ensure that the form is filled out correctly and completely.

- Once all sections are completed and verified for accuracy, you can save your changes, download the form, print it, or share it as necessary.

Complete your necessary documents online today for a smoother filing process.

If you're seeking to obtain $10,000 right away, the NY A-9K option is among the fastest routes available. By qualifying for the program, you can expedite access to these funds through a streamlined application. The US Legal Forms platform can help you gather the required documents and ensure that your application meets all necessary criteria. Taking these steps can significantly improve your chances of receiving assistance swiftly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.