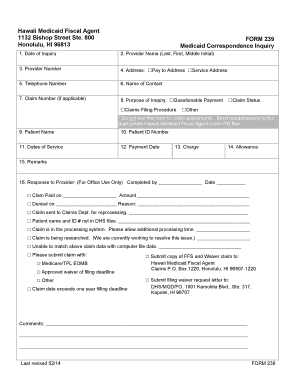

Get Hi Form 239 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign HI Form 239 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:The era of daunting complex legal and tax documents is behind us. With US Legal Forms, the entire procedure of filling out legal documents is stress-free. A powerful editor is at your disposal, providing various helpful tools for completing a HI Form 239. The following suggestions, along with the editor, will assist you throughout the whole process.

We simplify the completion of any HI Form 239. Utilize it now!

- Select the orange Get Form button to start editing.

- Enable the Wizard mode on the top toolbar for additional guidance.

- Complete each field that can be filled.

- Ensure the information you enter in HI Form 239 is current and precise.

- Specify the date on the template using the Date option.

- Click the Sign tool to create a digital signature. You have three options available: typing, drawing, or capturing one.

- Double-check that every area has been filled out accurately.

- Click Done in the upper right corner to save and send or download the document. There are multiple options for receiving the document: as an instant download, as an email attachment, or by mail as a printed copy.

Tips on how to fill out, edit and sign HI Form 239 online

How to fill out and sign HI Form 239 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of daunting complex legal and tax documents is behind us. With US Legal Forms, the entire procedure of filling out legal documents is stress-free. A powerful editor is at your disposal, providing various helpful tools for completing a HI Form 239. The following suggestions, along with the editor, will assist you throughout the whole process.

We simplify the completion of any HI Form 239. Utilize it now!

- Select the orange Get Form button to start editing.

- Enable the Wizard mode on the top toolbar for additional guidance.

- Complete each field that can be filled.

- Ensure the information you enter in HI Form 239 is current and precise.

- Specify the date on the template using the Date option.

- Click the Sign tool to create a digital signature. You have three options available: typing, drawing, or capturing one.

- Double-check that every area has been filled out accurately.

- Click Done in the upper right corner to save and send or download the document. There are multiple options for receiving the document: as an instant download, as an email attachment, or by mail as a printed copy.

How to modify Get HI Form 239 2014: personalize forms online

Utilize our sophisticated editor to change a basic online template into a finalized document. Continue reading to discover how to modify Get HI Form 239 2014 online effortlessly.

Once you locate an ideal Get HI Form 239 2014, all you need to do is tailor the template to your specifications or legal standards. Besides completing the fillable form with precise details, you might have to remove some clauses in the document that are not applicable to your situation. Conversely, you may wish to insert some omitted conditions from the original form. Our advanced document editing tools are the easiest method to adjust and amend the form.

The editor allows you to alter the content of any form, even if the file is in PDF format. You can add and delete text, insert fillable areas, and make additional modifications while maintaining the original formatting of the document. You can also rearrange the layout of the form by changing the page sequence.

There’s no need to print the Get HI Form 239 2014 for signing. The editor includes electronic signature features. Most forms already contain signature areas. Thus, you simply need to apply your signature and request one from the other signing party via email.

Follow this detailed guide to assemble your Get HI Form 239 2014:

After all parties finalize the document, you will receive a signed copy which you can download, print, and share with others.

Our services allow you to save a considerable amount of your time and decrease the chances of errors in your documents. Enhance your document workflows with effective editing tools and a robust eSignature solution.

- Open the chosen form.

- Utilize the toolbar to modify the form to your liking.

- Complete the form providing correct information.

- Click on the signature area and add your eSignature.

- Send the document for signing to other signers if necessary.

Yes, you can file your Hawaii state tax online, and it's a convenient option for most taxpayers. The state offers e-filing through their official platform, as well as various third-party services that can help you file HI Form 239 efficiently. Filing electronically expedites your refund process and increases the accuracy of your submissions. It's an ideal choice for those who prefer to manage their taxes from home.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.