Loading

Get Hi 204 Instructions 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HI 204 instructions online

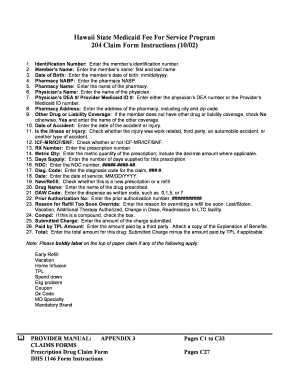

Completing the HI 204 form is essential for processing claims in the Hawaii State Medicaid Fee for Service Program. This guide provides clear, step-by-step instructions for filling out the necessary fields online, ensuring you can complete the process efficiently and accurately.

Follow the steps to fill out the HI 204 form online effectively.

- Press the ‘Get Form’ button to access the HI 204 form and open it in your preferred online editor.

- In the section for identification number, enter the member’s identification number accurately.

- For the member's name, input the first and last name as listed on the identification document.

- Provide the member's date of birth in the format mm/dd/yyyy.

- Enter the Pharmacy NABP to identify the pharmacy involved.

- Fill out the pharmacy name with the complete name as registered.

- Input the physician’s name who is prescribing the medication.

- In the provider section, you must enter either the physician’s DEA number or the Provider's Medicaid ID number.

- List the pharmacy address, including city and zip code.

- Indicate whether the member has other drug or liability coverage by checking 'No' or 'Yes,' and provide the name of the other coverage if applicable.

- If applicable, enter the date of the accident or injury.

- Specify the type of injury by checking the appropriate box (work-related, third party, automobile accident, etc.).

- Consult the ICF-MR/ICF/SNF section and check 'Yes' or 'No' as appropriate.

- Enter the prescription number (RX Number) assigned by the pharmacy.

- Fill in the metric quantity related to the prescription, ensuring to include decimals if necessary.

- Indicate the number of days supplied for this medicine.

- Input the NDC number in the format #####-####-##.

- Enter the diagnosis code relevant to the claim.

- Provide the date of service in the format MM/DD/YYYY.

- Check whether this prescription is new or a refill.

- Enter the name of the drug that was prescribed.

- Fill in the dispense as written (DAW) code indicating how the medication should be dispensed.

- Enter the prior authorization number if applicable.

- State the reason for needing a refill too soon, if relevant.

- If applicable, check the box for compound medicine.

- Submit the amount charged for the prescription.

- Enter any amount that was paid by a third party, attaching necessary documentation.

- Calculate and enter the total charge for the drug after subtracting any third party payment, if applicable.

- Make sure to label the top of the paper claim with alerts for early refill, vacation, or any other applicable notes.

Complete and submit your HI 204 form online to ensure timely processing of your claims.

Yes, you can extend the NY IT 204 LL filing deadline. This extension is similar to that granted at the federal level, but additional steps may be required on your part. To ensure everything is processed correctly, consult the HI 204 Instructions to understand the specifics of the extension process. Being diligent here can help you navigate your business obligations effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.