Loading

Get Uk P11d Ws2 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK P11D WS2 online

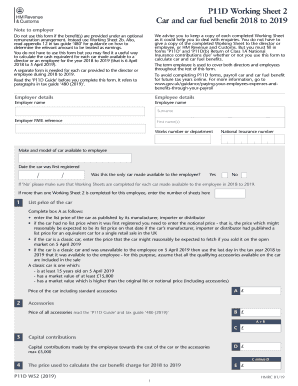

Filling out the UK P11D WS2 is essential for calculating car and car fuel benefits for directors and employees. This guide will walk you through each step of the online process to ensure accurate completion.

Follow the steps to fill out the form successfully.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter employer details, including the employer name and PAYE reference, ensuring accuracy in all provided information.

- Fill in employee details, such as the employee's surname, first name(s), works number or department, and National Insurance number.

- Input the make and model of the car that was available to the employee. Ensure this information is current and accurate.

- Record the date the car was first registered. This is critical for determining the benefit charge.

- Indicate whether this was the only car available to the employee. If no, make sure to complete additional Working Sheets for each car.

- Enter the list price of the car, following the guidelines provided regarding notional prices for cars without a listed price.

- Complete the pricing of accessories associated with the car, ensuring to read the P11D Guide for further details.

- Calculate the price used for determining the car benefit charge by taking the sum of the list price and accessories, and accounting for capital contributions made by the employee.

- Determine the appropriate percentage based on the car's registration date and CO2 emissions by referring to the relevant tables provided.

- Calculate the car benefit for the full year and make deductions for days the car was unavailable during the tax year.

- Finally, calculate the car fuel benefit charge if applicable, and enter all required information accurately.

- Upon completion, save changes, download, print, or share the form as necessary.

Complete your P11D WS2 form online today to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a company car is classified as a taxable benefit in the UK. This means that its monetary value must be reported on the P11D form, which affects the taxable income of the employee receiving the vehicle. Understanding this can help employees avoid unexpected tax bills and ensure accurate reporting through tools like UK P11D WS2.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.