Loading

Get Au Nat 1067 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 1067 online

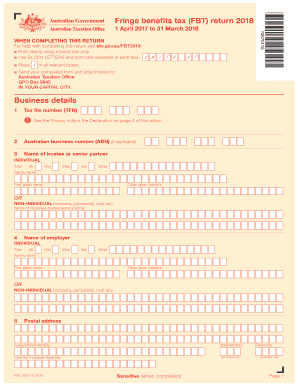

The AU NAT 1067 form is essential for reporting on fringe benefits tax (FBT) in Australia. This guide provides a clear, step-by-step approach to filling out the form online, ensuring accuracy and compliance.

Follow the steps to complete the AU NAT 1067 form accurately.

- Click ‘Get Form’ button to obtain the AU NAT 1067 form and open it in your document editor.

- Begin by entering your tax file number (TFN) in the designated box. Refer to the privacy note provided within the form for guidance.

- If applicable, input your Australian business number (ABN) in the next box. This is not mandatory for all users but is crucial for businesses.

- Provide the name of the trustee or senior partner. If it's an individual, include their title, family name, and given names. For non-individuals, enter the name of the corporate trustee or senior partner.

- Next, specify the name of the employer using the same guidelines as in step four. Ensure all details are accurate to avoid processing delays.

- Enter your postal address, including suburb, state/territory, and postcode. If outside Australia, include the country.

- If your employer name or postal address has changed, record it exactly as it appeared on the last FBT return lodged along with supporting documents if necessary.

- Detail the current business or trading name and address if these have changed, ensuring all entries are clear and specific.

- Input the name of the person to contact regarding the return, including their title, family name, first name, and any additional names.

- List the number of employees receiving fringe benefits during the specified period, ensuring the count is accurate.

- Specify the hours taken to prepare and complete the form. This should exclude any time spent by a tax agent.

- Indicate whether you expect to lodge FBT return forms for future years. Choose either 'Yes' for continued registration or 'No' to cancel.

- Provide your financial institution details for electronic funds transfer (EFT) to facilitate any potential refunds owed.

- Fill out the calculated fringe benefits taxable amounts and ensure all numerical data is correctly entered in whole dollars only.

- Complete the details regarding the fringe benefits provided, ensuring that you list each type accurately.

- Sign and date the employer's declaration section to confirm that all information included is true and correct before submitting the form.

- Once all sections are complete, review the information for accuracy. Save your changes, and you can download, print, or share the completed form as needed.

Ensure your financial obligations are met by completing your AU NAT 1067 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The grossed up value of fringe benefits is the amount used to determine the employer's FBT liability. It accounts for the GST component and allows for more precise calculations. Businesses can refer to AU NAT 1067 for guidance on how to correctly gross up these values, ensuring they meet their tax responsibilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.