Loading

Get Canada Pshcp Ehc-55555-e 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada PSHCP EHC-55555-E online

Filling out the Canada PSHCP EHC-55555-E form online can be straightforward if you follow the proper steps. This guide provides detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

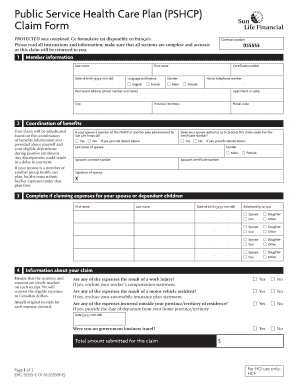

- In the member information section, provide your last name, first name, and date of birth in the format yyyy-mm-dd. Indicate your language preference and gender by selecting the appropriate options.

- Fill in your certificate number, home telephone number, and permanent address, which includes the street number and name, city, apartment or suite number (if applicable), province or territory, and postal code.

- Proceed to the coordination of benefits section. Indicate whether your spouse is a member of the PSHCP or another plan administered by Sun Life Financial by selecting 'Yes' or 'No.' If applicable, provide your spouse's details.

- Complete the section for claiming expenses for your spouse or dependant children by entering the required information for each individual, including first name, last name, date of birth, and their relationship to you.

- In the information about your claim section, answer whether any of the expenses are a result of a work injury or a motor vehicle accident by checking 'Yes' or 'No.' Attach all original receipts for the expenses claimed.

- If any of the expenses were incurred outside your province or territory of residence, provide the date of departure. Fill in the total amount submitted for the claim.

- In the authorization and signature section, read the declaration carefully, then sign and date the form in the provided spaces.

- Review your completed form for accuracy, then save changes, download, print, or share the form as needed.

Complete your Canada PSHCP EHC-55555-E form online today.

The Extended Health Care (EHC) benefits under Canada PSHCP EHC-55555-E are generally not considered taxable income in Canada. This means that you do not include these benefits in your annual tax returns. However, it's wise to consult a tax professional for specific advice related to your situation and any changes in tax law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.