Loading

Get Oh Pedackn 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH PEDACKN online

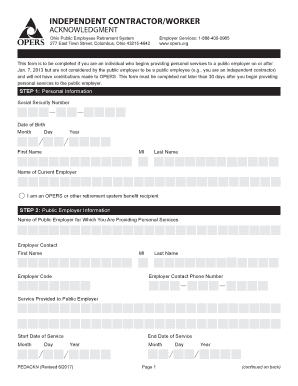

The OH PEDACKN form is essential for individuals providing personal services to a public employer in Ohio who are classified as independent contractors. This guide will provide you with clear step-by-step instructions on how to complete the form efficiently and accurately online.

Follow the steps to complete the OH PEDACKN form online.

- Press the ‘Get Form’ button to access the OH PEDACKN form, enabling you to fill it out online.

- In Step 1, enter your personal information including your Social Security number, date of birth, first name, middle initial, last name, and the name of your current employer. You also need to indicate if you are a recipient of OPERS or another retirement system benefit.

- Next, in Step 2, provide information about the public employer for whom you are offering personal services. Fill in the employer’s name, the contact person's first name, middle initial, last name, and their phone number. Also, include the service you are providing and the corresponding start and end dates of your service.

- In Step 3, you will acknowledge that the public employer has classified you as an independent contractor. Carefully read through the acknowledgment requirements as outlined, and by signing the form, you confirm your understanding of your classification and associated implications.

- Lastly, ensure that all sections are completed accurately. Once you have reviewed your entries, you can save any changes made to the form, download it, print the completed form, or share it as needed.

Complete your OH PEDACKN form online today for a smooth submission process.

A 1099 contractor is typically an individual who provides services to a business but operates independently. They are not considered employees, which means they handle their own taxes and do not receive typical employee benefits. Understanding this classification is crucial for compliance, and OH PEDACKN can help clarify any doubts you may have.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.