Loading

Get 2000 Schedule Ca 540 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Schedule CA 540 Form online

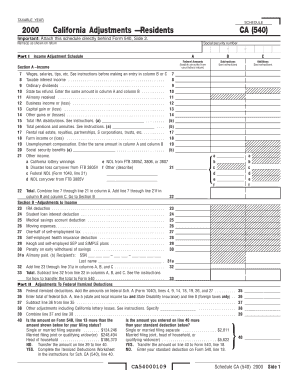

Filling out the 2000 Schedule CA 540 Form online can be a straightforward process if you follow clear instructions. This guide will help individuals understand how to accurately complete each section and field of the form to ensure proper filing.

Follow the steps to fill out the 2000 Schedule CA 540 Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name(s) as shown on your return along with your Social Security number. Ensure all personal identifiers are accurate to avoid any issues.

- Begin with Part I - Income Adjustment Schedule. In Section A, start entering federal amounts for taxable incomes as reported on your federal return in column A.

- In column B, report any subtractions from this income according to the instructions provided. For typical entries, refer to the income sources like wages, interest, and dividends.

- In column C, add any required additions to your income that were not included in your federal amounts.

- Continue to Section B - Adjustments to Income. Here, enter specific deductions you are eligible for, such as IRA deductions and student loan interest.

- Calculate the total adjustments by adding specific lines as instructed and transfer the calculated values to the appropriate lines on the form.

- Proceed to Part II for Adjustments to Federal Itemized Deductions if applicable. Complete the respective fields for federal itemized deductions and any required adjustments.

- Conduct a final review of all entries to check for accuracy and completeness. Make sure all calculations align with your federal forms.

- Once satisfied with the information entered, you can save any changes made to the form, download it for your records, print it if needed, or share it as required.

Complete your 2000 Schedule CA 540 Form online for a smoother filing process.

No, not everyone receives a Schedule C tax form. This form is specifically for self-employed individuals and sole proprietors reporting their business income and expenses. If you are filing taxes in California, you might also need to consider attaching the 2000 Schedule CA 540 Form, depending on your circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.