Get Mo Modes-4282 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MODES-4282 online

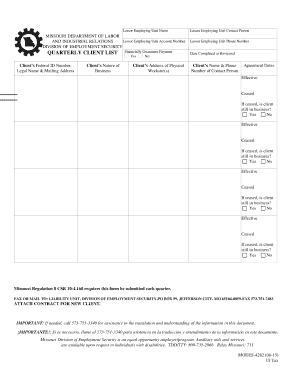

Filling out the MO MODES-4282 form is an essential task for ensuring compliance with Missouri's employment regulations. This guide will provide you with a clear and concise method to complete this online form accurately, step by step.

Follow the steps to fill out the MO MODES-4282 form online effectively.

- Press the ‘Get Form’ button to access the MO MODES-4282 form and open it in your preferred online editor.

- In the first section, enter the lessor employing unit name and their account number as issued by the Missouri Department of Labor and Industrial Relations.

- Fill in the client's federal ID number, legal name, and mailing address accurately in the respective fields.

- Indicate the nature of the client's business by providing a brief description in the designated section.

- For the financial guarantee payment question, select 'Yes' or 'No' to indicate the client's agreement status.

- Complete the client's address for their physical worksite(s) in the provided area.

- Identify the contact person for the lessor employing unit and provide their phone number.

- Record the date when the document was completed or reviewed.

- Fill in the client’s name and contact number for the designated contact person.

- Specify the agreement dates, including the effective dates and any ceased periods, answering whether the client is still in business for each time frame provided.

- If applicable, ensure to attach a contract for any new client as per the guidelines.

- Once all sections are completed, save your changes and choose to download, print, or share the form as necessary.

Start filling out the MO MODES-4282 online today to ensure compliance and accurate record-keeping.

To obtain your 1099-G from Missouri, you can request it online through the Missouri Department of Revenue’s official site. You may need to provide personal details to verify your identity. Additionally, if you prefer direct assistance, contacting their customer service can help you access the document. Utilizing the services of uslegalforms can also aid in navigating this request while managing your affairs under MO MODES-4282.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.